Posts Tagged ‘less-with-far-less’

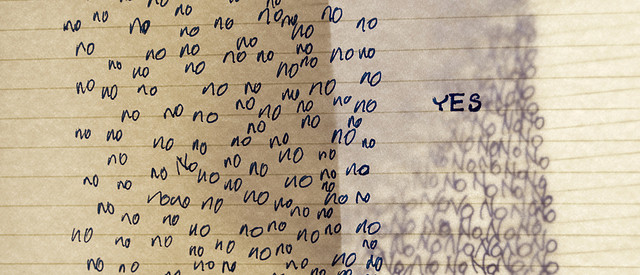

Battle Success With No-To-Yes

Everyone says they want innovation, but they don’t – they want the results of innovation.

Everyone says they want innovation, but they don’t – they want the results of innovation.

Innovation is about bringing to life things that are novel, useful and successful. Novel and useful are nice, but successful pays the bills. Novel means new, and new means fear; useful means customers must find value in the newness we create, and that’s scary. No one likes fear, and, if possible, we’d skip novel and useful altogether, but we cannot. Success isn’t a thing in itself, success is a result of something, and that something is novelty and usefulness.

Companies want success and they want it with as little work and risk as possible, and they do that with a focus on efficiency – do more with less and stock price increases. With efficiency it’s all about getting more out of what you have – don’t buy new machines or tools, get more out of what you have. And to reduce risk it’s all about reducing newness – do more of what you did, and do it more efficiently. We’ve unnaturally mapped success with the same old tricks done in the same old way to do more of the same. And that’s a problem because, eventually, sameness runs out of gas.

Innovation starts with different, but past tense success locks us into future tense sameness. And that’s the rub with success – success breeds sameness and sameness blocks innovation. It’s a strange duality – success is the carrot for innovation and also its deterrent. To manage this strange duality, don’t limit success; limit how much it limits you.

The key to busting out of the shackles of your success is doing more things that are different, and the best way to do that is with no-to-yes.

If your product can’t do something then you change it so it can, that’s no-to-yes. By definition, no-to-yes creates novelty, creates new design space and provides the means to enter (or create) new markets. Here’s how to do it.

Scan all the products in your industry and identify the product that can operate with the smallest inputs. (For example, the cell phone that can run on the smallest battery.) Below this input level there are no products that can function – you’ve identified green field design space which you can have all to yourself. Now, use the industry-low input to create a design constraint. To do this, divide the input by two – this is the no-to-yes threshold. Before you do you the work, your product cannot operate with this small input (no), but after your hard work, it can (yes). By definition the new product will be novel.

Do the same thing for outputs. Scan all the products in your industry to find the smallest output. (For example, the automobile with the smallest engine.) Divide the output by two and this is your no-to-yes threshold. Before you design the new car it does not have an engine smaller than the threshold (no), and after the hard work, it does (yes). By definition, the new car will be novel.

A strange thing happens when inputs and outputs are reduced – it becomes clear existing technologies don’t cut it, and new, smaller, lower cost technologies become viable. The no-to-yes threshold (the constraint) breaks the shackles of success and guides thinking in a new directions.

Once the prototypes are built, the work shifts to finding a market the novel concept can satisfy. The good news is you’re armed with prototypes that do things nothing else can do, and the bad news is your existing customers won’t like the prototypes so you’ll have to seek out new customers. (And, really, that’s not so bad because those new customers are the early adopters of the new market you just created.)

No-to-yes thinking is powerful, and though I described how it’s used with products, it’s equally powerful for services, business models and systems.

If you want innovation (and its results), use no-to-yes thinking to find the limits and work outside them.

Innovation Through Preparation

Innovation is about new; innovation is about different; innovation is about “never been done before”; and innovation is about preparation.

Innovation is about new; innovation is about different; innovation is about “never been done before”; and innovation is about preparation.

Though preparation seems to contradict the free-thinking nature of innovation, it doesn’t. In fact, where brainstorming diverts attention, the right innovation preparation focuses it; where brainstorming seeks more ideas, preparation seeks fewer and more creative ones; where brainstorming does not constrain, effective innovation preparation does exactly that.

Ideas are the sexy part of innovation; commercialization is the profitable part; and preparation is the most important part. Before developing creative, novel ideas, there must be a customer of those ideas, someone that, once created, will run with them. The tell-tale sign of the true customer is they have a problem if the innovation (commercialization) doesn’t happen. Usually, their problem is they won’t make their growth goals or won’t get their bonus without the innovation work. From a preparation standpoint, the first step is to define the customer of the yet-to-be created disruptive concepts.

The most effective way I know to create novel concepts is the IBE (Innovation Burst Event), where a small team gets together for a day to solve some focused design challenges and create novel design concepts. But before that can happen, the innovation preparation work must happen. This work is done in the Focus phase. The questions and discussion below defines the preparation work for a successful IBE.

1. Why is it so important to do this innovation work?

What defines the need for the innovation work? The answer tells the IBE team why they’re in the room and why their work is important. Usually, the “why” is a growth goal at the business unit level or projects in the strategic plan that are missing the necessary sizzle. If you can’t come up with a slide or two with growth goals or new projects, the need for innovation is only emotional. If you have the slides, these will be used to kick off the IBE.

2. Who is the customer of the novel concepts?

Who will choose which concepts will be converted into working prototypes? Who will convert the prototypes into new products? Who will launch the new products? Who has the authority to allocate the necessary resources? These questions define the customers of the new concepts. Once defined, the customers become part of the IBE team. The customers kick off the IBE and explain why the innovation work is important and what they’ll do with the concepts once created. The customers must attend the IBE report-out and decide which concepts they’ll convert to working prototypes and patents.

Now, so the IBE will generate the right concepts, the more detailed preparation work can begin. This work is led by marketing. Here are the questions to scope and guide the IBE.

3. How will the innovative new product be used?

How will the innovative product be used in new way? This question is best answered with a hand sketch of the customer using the new product in a new way, but a short written description (30 words, or so) will do in a pinch. The answer gives the IBE team a good understanding, from a customer perspective, what new things the product must do.

What are the new elements of the design that enable the new functionality or performance? The answer focuses the IBE on the new design elements needed to make real the new product function in the new way.

What are the valuable customer outcomes (VCOs) enabled by the innovative new product? The answer grounds the IBE team in the fundamental reason why the customer will buy the new product. Again, this is answered from the customer perspective.

4. How will the new innovative new product be marketed and sold?

What is the tag line for the new product? The answer defines, at the highest level, what the new product is all about. This shapes the mindset of the IBE team and points them in the right direction.

What is the major benefit of the new product? The answer to this question defines what your marketing says in their marketing/sales literature. When the IBE team knows this, you can be sure the new concepts support the marketing language.

5. By whom will the innovative new product be used?

In which geography does the end user live? There’s a big difference between developed markets and developing markets. The answer to the question sets the context for the new concepts, specifically around infrastructure constraints.

What is their ability to pay? Pocketbooks are different across the globe, and the customer’s ability to pay guides the IBE team toward concepts that fit the right pocket book.

What is the literacy level of the end customer? If the customer can read, the IBE team creates concepts that take advantage of that ability. If the customer cannot read, the IBE team creates concepts that are far different.

6. How will the innovative new product change the competitive landscape?

Who will be angry when the new product hits the market? The answer defines the competition. It gives broad context for the IBE team and builds emotional energy around displacing adversaries.

Why will they be angry? With the answer to this one, the IBE team has good perspective on the flavor of pain and displeasure created by the concepts. Again, it shapes the perspective of the IBE team. And, it educates the marketing/sales work needed to address competitors’ countermeasures.

Who will benefit when the new product hits the market? This defines new partners and supporters that can be part of the new solutions or participants in a new business model or sales process.

What will customer throw away, reuse, or recycle? This question defines the level of disruption. If the new products cause your existing customers to throw away the products of your existing customers, it’s a pure market share play. The level of disruption is low and the level of disruption of the concepts should also be low. On the other end of the spectrum, if the new products are sold to new customers who won’t throw anything away, you creating a whole new market, which is the ultimate disruption, and the concepts must be highly disruptive. Either way, the IBE team’s perspective is aligned with the level appropriate level of disruption, and so are the new concepts.

Answering all these questions before the creative works seems like a lot of front-loaded preparation work, and it is. But, it’s also the most important thing you can do to make sure the concept work, technology work, patent work, and commercialization work gives your customers what they need and delivers on your company’s growth objectives.

Image credit — ccdoh1.

Don’t boost innovation, burst it.

The most difficult part of innovation is starting, and the best way to start is the Innovation Burst Event, or IBE. The IBE is a short, focused event with three objectives: to learn innovation methods, to provide hands-on experience, and to generate actual results. In short, the IBE is a great way to get started.

The most difficult part of innovation is starting, and the best way to start is the Innovation Burst Event, or IBE. The IBE is a short, focused event with three objectives: to learn innovation methods, to provide hands-on experience, and to generate actual results. In short, the IBE is a great way to get started.

There are a couple flavors of IBEs, but the most common is a single day even where a small, diverse group gets together to investigate some bounded design space and to create novel concepts. At the start, a respected company leader explains to the working group the importance of the day’s work, how it fits with company objectives, and sets expectations there will be a report out at the end of the day to review the results. During the event, the working group is given several design challenges, and using innovation tools/methods, creates new concepts and builds “thinking prototypes.” The IBE ends with a report out to company leaders, where the working group identifies patentable concepts and concepts worthy of follow-on work. Company leaders listen to the group’s recommendations and shape the go-forward actions.

The key to success is preparation. To prepare, interesting design space is identified using multiple inputs: company growth objectives, new market development, the state of the technology, competitive landscape and important projects that could benefit from new technology. And once the design space is identified, the right working group is selected. It’s best to keep the group small yet diverse, with several important business functions represented. In order to change the thinking, the IBE is held at location different than where the day-to-day work is done – at an off-site location. And good food is provided to help the working group feel the IBE is a bit special.

The most difficult and most important part of preparation is choosing the right design space. Since the selection process starts with your business objectives, the design space will be in line with company priorities, but it requires dialing in. The first step is to define the operational mechanism for the growth objective. Do you want a new product or process? A new market or business model? The next step is to choose if you want to radically improve what you have (discontinuous improvement) or obsolete your best work (disruption). Next, the current state is defined (knowing the starting point is more important than the destination) – Is the technology mature? What is the completion up to? What is the economy like in the region of interest? Then, with all that information, several important lines of evolution are chosen. From there, design challenges are created to exercise the design space. Now it’s time for the IBE.

The foundation of the IBE is the build-to-think approach and its building blocks are the design challenges. The working group is given a short presentation on an innovation tool, and then they immediately use the tool on a design challenge. The group is given a short description of the design challenge (which is specifically constructed to force the group from familiar thinking), and the group is given an unreasonably short time, maybe 15-20 minutes, to create solutions and build thinking prototypes. (The severe time limit is one of the methods to generate bursts of creativity.) The thinking prototype can be a story board, or a crude representation constructed with materials on hand – e.g., masking tape, paper, cardboard. The group then describes the idea behind the prototype and the problem it solves. A mobile phone is used to capture the thinking and the video is used at the report out session. The process is repeated one or two times, based on time constraints and nature of the design challenges.

About an hour before the report out, the working group organizes and rationalizes the new concepts and ranks them against impact and effort. They then recommend one or two concepts worthy of follow on work and pull together high level thoughts on next steps. And, they choose one or two concept that may be patentable. The selected concepts, the group’s recommendations, and their high level plans are presented at the report out.

At the report out, company leaders listen to the working group’s thoughts and give feedback. Their response to the group’s work is crucial. With right speech, the report out is an effective mechanism for leaders to create a healthy innovation culture. When new behaviors and new thinking are praised, the culture of innovation moves toward the praise. In that way, the desired culture can be built IBE by IBE and new behaviors become everyday behaviors.

Innovation is a lot more than Innovation Burst Events, but they’re certainly a central element. After the report out, the IBE’s output (novel concepts) must be funneled into follow on projects which must be planned, staffed, and executed. And then, as the new concepts converge on commercialization, and the intellectual comes on line, the focus of the work migrates to the factory and the sales force.

The IBE is designed to break through the three most common innovation blockers – no time to do innovation; lack of knowledge of how do innovation (though that one’s often unsaid); and pie-in-the-sky, brainstorming innovation is a waste of time. To address the time issue, the IBE is short – just one day. To address the knowledge gap, the training is part of the event. And to address the pie-in-the-sky – at the end of the day there is tangible output, and that output is directly in line with the company’s growth objectives.

It’s emotionally challenging to do work that destroys your business model and obsoletes your best products, but that’s how it is with innovation. But for motivation, think about this – if your business model is going away, it’s best if you make it go away, rather than your competition. But your competition does end up changing the game and taking your business, I know how they’ll do it – with Innovation Burst Events.

Image credit – Pascal Bovet

Are you doing innovation?

If you’re not thinking differently, you’re thinking the same. And if you’re thinking the same, you’re going to get the same. Same may feel safe, and at some level it is. But when sameness festers into staleness, too much of a good thing isn’t wonderful.

If you’re not thinking differently, you’re thinking the same. And if you’re thinking the same, you’re going to get the same. Same may feel safe, and at some level it is. But when sameness festers into staleness, too much of a good thing isn’t wonderful.

In our fast moving Bizzaro World, safe is dangerous; repeatable is out and remarkable is in; improving what is is displaced by creating what isn’t; more capacity is outlawed and new capability is the only way; growing existing markets is wasteful because it gets in the way of creating new ones.

Ask your company leaders if they’re doing innovation, and the answer is yes. It’s a loaded question, and nothing good can come of it. “No, we don’t do innovation.” is a career-limiting response. Here are two better questions: What are you doing that’s different? What are you doing differently? These questions are effective because they require answers that are relative – relative to what you used to do. And because innovation starts with different, these questions are a good start.

Our assembly process is different and we increased productivity 0.3%; our product design is different and we made it stronger by 2.1%; our customer service tools are different and we decrease waiting time by 1.7%; our plastics are different and we reduced product cost by 0.6%. The difference is clear, but it didn’t really make a difference. Innovation starts with different, but all different isn’t created equal. Instead of shades of gray, think binary, think black to white, think no to yes.

Here are some better questions:

- Have we stopped distracting ourselves by focusing on growth of our biggest markets?

- Did we change the value proposition with our new product?

- Have we increased sales people in the undeveloped markets at the expense of sales people in our biggest markets?

- Do our new technologies change the argument?

- Are we working on the new products that will obsolete our most profitable product?

- Does the new product do less of anything so it can do more of something else?

- Are we working on the technologies so we can sell into Africa?

- Are we hiring experts in mobile technology?

- How about experts in data science?

There’s no hard and fast definition of what makes for the right no-to-yes thinking but their telltale sign is their wake of oblique problems. If your organization doesn’t know how to do something, then it could be an indication of powerful no-to-yes behavior. For example, if your translations group doesn’t know how to translate into a new language requested by sales, it could be because a new region of the world is now important. If your sales managers want to use a new search firm because your longstanding one can’t find the right new candidates, it may be because your new product demands a new flavor of sales people. If your compensation structure doesn’t let you make an acceptable offer to an engineer you really need, it could be because you need to hire for new specialties from different industries with radically different compensation norms.

“Are you doing innovation?”, as a question, is not skillful. Instead, do the work so you must sell where you haven’t sold; use materials you’ve never used; use technologies you’ve never heard of; hire people you never had to hire; and create problems related to new geographies and new languages. And when someone asks “Are you doing innovation?”, tell them you used to, but you’ve found something better.

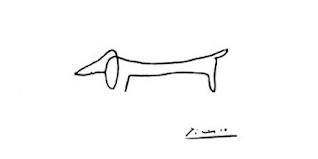

Image credit – JD HANCOCK PHOTOS

Innovation’s Mantra – Sell New Products To New Customers

There are three types of innovation: innovation that creates jobs, innovation that’s job neutral, and innovation that reduces jobs.

There are three types of innovation: innovation that creates jobs, innovation that’s job neutral, and innovation that reduces jobs.

Innovation that reduces jobs is by far the most common. This innovation improves the efficiency of things that already exist – the mantra: do the same, but with less. No increase in sales, just fewer people employed.

Innovation that’s job neutral is less common. This innovation improves what you sell today so the customer will buy the new one instead of the old one. It’s a trade – instead of buying the old one they buy the new one. No increase in sales, same number of people employed.

Innovation that creates jobs is uncommon. This innovation radically changes what you sell today and moves it from expensive and complicated to affordable and accessible. Sell more, employ more.

Clay Christensen calls it Disruptive Innovation; Vijay Govindarajan calls it Reverse Innovation; and I call it Less-With-Far-Less.

The idea is the product that is sold to a relatively small customer base (due to its cost) is transformed into something new with far broader applicability (due to its hyper-low cost). Clay says to “look down” to see the new technologies that do less but have a super low cost structure which reduces the barrier to entry. And because more people can afford it, more people buy it. And these aren’t the folks that buy your existing products. They’re new customers.

Vijay says growth over the next decades will come from the developing world who today cannot afford the developed world’s product. But, when the price comes down (down by a factor of 10 then down by a factor of 100), you sell many more. And these folks, too, are new customers.

I say the design and marketing communities must get over their unnatural fascination with “more” thinking. To sell to new customers the best strategy is increase the number of people who can afford your product. And the best way to do that is to radically reduce the cost signature at the expense of features and function. If you can give ground a bit on the thing that makes your product successful, there is huge opportunity to reduce cost – think 80% less cost and 20% less function. Again, you sell new product to new customers.

Here’s a thought experiment to help put you in the right mental context: Create a plan to form a new business unit that cannot sell to your existing customers, must sell a product that does less (20%) and costs far less (80%), and must sell it in the developing world. Now, create a list of small projects to test new technologies with radically lower cost structures, likely from other industries. The constraint on the projects – you must be able to squeeze them into your existing workload and get them done with your existing budget and people. It doesn’t matter how long the projects take, but the investment must be below the radar.

The funny thing is, if you actually run a couple small projects (or even just one) to identify those new technologies, for short money you’ve started your journey to selling new products to new customers.

Less Before More – Innovation’s Little Secret

The natural mindset of innovation is more-centric. More throughput; more performance; more features and functions; more services; more sales regions and markets; more applications; more of what worked last time. With innovation, we naturally gravitate toward more.

The natural mindset of innovation is more-centric. More throughput; more performance; more features and functions; more services; more sales regions and markets; more applications; more of what worked last time. With innovation, we naturally gravitate toward more.

There are two flavors of more, one better than the other. The better brother is more that does something for the first time. For example, the addition of the first airbags to automobiles – clearly an addition (previous vehicles had none) and clearly a meaningful innovation. More people survived car crashes because of the new airbags. This something-from-nothing more is magic, innovative, and scarce.

Most more work is of a lesser class – the more-of-what-is class. Where the first airbags were amazing, moving from eight airbags to nine – not so much. When the first safety razors replaced straight razors, they virtually eliminated fatal and almost fatal injuries, which was a big deal; but when the third and fourth blades were added, it was more trivial than magical. It was more for more’s sake; it was more because we didn’t know what else to do.

While more is more natural, less is more powerful. The Innovator’s Dilemma clearly called out the power of less. When the long-in-the-tooth S-curve flattens, Christensen says to look down, to look down and create technologies that do less. Actually, he tells us someone will give ground on the very thing that built the venerable S-curve to make possible a done-for-the-first-time innovation. He goes on to say you might as well be the one to dismantle your S-curve before a somebody else beats you to it. Yes, a wonderful way to realize the juciest innovation is with a less-centric mindset.

The LED revolution was made possible with less-centric thinking. As the incandescent S-curve hit puberty, wattage climbed and more powerful lights became cost effective; and as it matured, output per unit cost increased. More on more. And looking down from the graying S-curve was the lowly LED, whose output was far, far less.

But what the LED gave up in output it gained in less power draw and smaller size. As it turned out, there was a need for light where there had been none – in highly mobile applications where less size and weight were prized. And in these new applications, there was just a wisp of available power, and incandesent’s power draw was too much. If only there was a technology with less power draw.

But at the start, volumes for LEDs were far less than incandesent’s; profit margin was less; and most importantly, their output was far less than any self-respecting lightbulb. From on high, LEDs weren’t real lights; they were toys that would never amount to anything.

You can break intellectual inertia around more, and good things will happen. New design space is created from thin air once you are forced from the familiar. But it takes force. Creative use of constraints can help.

Get a small team together and creatively construct constraints that outlaw the goodness that makes your product great. The incandescent group’s constraint could be: create a light source that must make far less light. The automotive group’s constraint: create a vehicle that must have less range – battery powered cars. The smartphone group: create a smartphone with the fewest functions – wrist phone without Blutooth to something in your pocket , longer battery life, phone in the ear, phone in your eyeglasses.

Less is unnatural, and less is scary. The fear is your customers will get less and they won’t like it. But don’t be afraid because you’re going to sell to altogether different customers in altogether markets and applications. And fear not, because to those new customers you’ll sell more, not less. You’ll sell them something that’s the first of its kind, something that does more of what hasn’t been done before. It may do only a little bit of that something, but that’s far more than not being able to do it all.

Don’t tell anyone, but the next level of more will come from less.

Moving at the Speed of People

More-with-less is our mantra for innovation. But these three simple words are dangerous because they push us almost exclusively toward efficiency. On the surface, efficiency innovations sound good, and they can be, but more often than not efficiency innovations are about less and fewer. When you create a new technology that does more and costs less the cost reduction comes from fewer hours by fewer people. And if the cash created by the efficiency finances more efficiency, there are fewer jobs. When you create an innovative process that enables a move from machining to forming, hard tooling and molding machines reduce cost by reducing labor hours. And if the profits fund more efficiency, there are fewer jobs. When you create an innovative new material that does things better and costs less, the reduced costs come from fewer labor hours to process the material. And if more efficiency is funded, there are less people with jobs. (The cost reduction could also come from lower cost natural resources, but their costs are low partly because digging them up is done with fewer labor hours, or more efficiently.)

More-with-less is our mantra for innovation. But these three simple words are dangerous because they push us almost exclusively toward efficiency. On the surface, efficiency innovations sound good, and they can be, but more often than not efficiency innovations are about less and fewer. When you create a new technology that does more and costs less the cost reduction comes from fewer hours by fewer people. And if the cash created by the efficiency finances more efficiency, there are fewer jobs. When you create an innovative process that enables a move from machining to forming, hard tooling and molding machines reduce cost by reducing labor hours. And if the profits fund more efficiency, there are fewer jobs. When you create an innovative new material that does things better and costs less, the reduced costs come from fewer labor hours to process the material. And if more efficiency is funded, there are less people with jobs. (The cost reduction could also come from lower cost natural resources, but their costs are low partly because digging them up is done with fewer labor hours, or more efficiently.)

But more-with-less and the resulting efficiency improvements are helpful when their profits are used to fund disruptive innovation. With disruptive innovation the keywords are still less and fewer, but instead of less cost, the product’s output is less; and instead of fewer labor hours, the product does fewer things and satisfies fewer people.

It takes courage to run innovation projects that create products that do less, but that’s what has to happen. When disruptive technologies are young they don’t perform as well as established technologies, but they come with hidden benefits that ultimatley spawn new markets, and that’s what makes them special. But in order to see these translucent benefits you must have confidence in yourself, openness, and a deep personal desire to make a difference. But that’s not enough because disruptive innovations threaten the very thing that made you successful – the products you sell today and the people that made it happen. And that gets to the fundamental difference between efficiency innovations and disruptive innovations.

Efficiency innovations are about doing the familiar in a better way – same basic stuff, similar product functionality, and sold the same way to the same people. Disruptive innovations are about doing less than before, doing it with a less favorable cost signature, and doing it for different (and far fewer) people. Where efficiency innovation is familiar, disruptive innovation is contradictory. And this difference sets the the pace of the two innovations. Where efficiency innovation is governed by the speed of the technology, disruptive innovation is governed by the speed of people.

With efficiency innovations, when the technology is ready it jumps into the product and the product jumps into the market. With disruptive innovations, when the technology is ready it goes nowhere because people don’t think it’s ready – it doesn’t do enough. With efficiency innovations, the new technology serves existing customers so it launches; with disruptive, technology readiness is insufficient because people see no existing market and no existing customers so they make it languish in the corner. With efficiency, it launches when ready because margins are better than before; with disruptive, it’s blocked because people don’t see how the new technology will ultimately mature to overtake and replace the tired mainstream products (or maybe because they do.)

Done poorly efficiency innovation is a race to the bottom; done well it funds disruptive innovation and the race to the top. When coordinated the two play together nicely, but they are altogether different. One is about doing the familiar in a more efficient way, and the other is about disrupting and displacing the very thing (and people) that made you successful.

Most importantly, efficiency innovation moves at the speed of technology while disruptive innovation moves at the speed of people.

A Race To The Top

We all want to increase sales. But to do do this, our products must offer a better value proposition – they must increase the goodness-to-cost ratio. And to do this we increase goodness and decrease cost. (No argument here – this is how everyone does it.) When new technologies mature, we design them in to increase goodness and change manufacturing and materials to reduce cost. Then, we sell. This is the proven cowpath. But there’s a problem.

We all want to increase sales. But to do do this, our products must offer a better value proposition – they must increase the goodness-to-cost ratio. And to do this we increase goodness and decrease cost. (No argument here – this is how everyone does it.) When new technologies mature, we design them in to increase goodness and change manufacturing and materials to reduce cost. Then, we sell. This is the proven cowpath. But there’s a problem.

The problem is everyone is thinking this way. You’re watching/developing the same technologies as your competitors; improving the same manufacturing processes; and trying the same materials. On its own, this a recipe for hyper-competition. But with the sinking economy driving more focus on fewer consumers, price is the differentiator. With this cowpath it’s a race to the bottom.

But there’s a better way where there are no competitors and millions (maybe billions) of untapped consumers clamoring for new products. Yes, it’s based on the time-tested method of improving the goodness-to-cost ratio, but there’s a twist – instead of more it’s less. The ratio is increased with less goodness and far less cost. Since no one in their right mind will take this less-with-far-less approach, there is no competition – it’s just you. And because you will provide less goodness, you must sell where others don’t – into the untapped sea of yet-to-be consumers of developing world. With less-with-far-less it’s a race to the top.

Technology is the most important element of less-with-far-less. By reducing some goodness requirements and dropping others all together, immature technologies become viable. You can incorporate fledgeling technologies sooner and commercialize products with their unreasonably large goodness-to-cost ratios. The trick – think less output and narrow-banded goodness.

Immature technologies have improved goodness-to-cost ratios (that’s why we like them), but their output is low. But when a product is designed to require less output, previously immature technologies become viable. Sure, there’s a little less goodness, but the cost structure is far less – just right for the developing world.

Immature technologies are more efficient and smaller, but their operating range is small. But when a product is designed to work within a narrow band of goodness, technologies become viable sooner. Yes, the product does less, but the cost structure is far less – a winning combination for the developing world.

Less-with-far-less makes the product fit the technology – that’s not the hard part. And less-with-far-less makes the product fit the developing world – not hard. In our all-you-can-eat world, where more is seen as the only way, we can’t comprehend how less can win the race to the top. The hard part is less.

Less-with-far-less is not limited by technology or market – it’s limited because we can’t see less as more.

Less-With-Far-Less for the Developing World

The stalled world economy will make growth difficult, and companies are digging in for the long haul, getting ready to do more of what they do best – add more function and features, sell more into existing markets, and sell more to existing customers. More of the same, but better. But growth will not come easy with more-on-more thinking. It will be more-on-more trench warfare – ugly hand-to-hand combat with little ground gained. It’s time for another way. It’s time for less. It’s time to create new markets with less-with-far-less thinking.

The stalled world economy will make growth difficult, and companies are digging in for the long haul, getting ready to do more of what they do best – add more function and features, sell more into existing markets, and sell more to existing customers. More of the same, but better. But growth will not come easy with more-on-more thinking. It will be more-on-more trench warfare – ugly hand-to-hand combat with little ground gained. It’s time for another way. It’s time for less. It’s time to create new markets with less-with-far-less thinking.

Real growth will come from markets and consumers that don’t exist. Real (and big) growth will come from the developing world. They’re not buying now, but they will. They will when product are developed that fit them. But here’s the kicker – products for the developed world cannot be twisted and tweaked to fit. Your products must be re-imagined.

The fundamentals are different in the developing world. Three important ones are – ability to pay, population density, and literacy/skill.

The most important fundamental is the developing world’s ability to pay. They will buy, but to buy products must cost 10 to 100 times less. (No typo here – 10 to 100 times less.) Traditional cost reduction approaches such as Design for Manufacturing and Assembly (DFMA) won’t cut it – their 50% cost reductions are not even close. Reinvention is needed; radical innovation is needed; fundamental innovation is needed. Less-with-far-less thinking is needed.

To achieve 10-100X cost reductions, the product must do less and do it far more efficiency (with far less). Product functionality must be decimated – ripped off the bone until only bone remains. The product must do only one thing. Not two – one. The product must be stripped to its essence, and new technology must be developed to radically improve efficiency of delivering its essence. Products for the developing world will require higher levels of technology than products for the developed world.

Radical narrowing of functionality will make viable the smaller, immature, more efficient technologies. Infant technologies usually have lower output and less breadth, but that’s just what’s needed – narrow, deep, and less. Less-with-far-less.

In the developing world, population density is low. People are spread out, and rural is the norm. And it’s not developed world rural, it’s three-day-hike rural. In the developing world, people don’t go to products; products go to people. If it’s not portable, it won’t sell. And developing world portable does not mean wheels – it means backpack. Your products must fit in a backpack and must be light enough to carry in one.

Big, stationary, expensive equipment is not exempt. It also must fit in a backpack. And this cannot be achieved with twist-and-bend engineering. To fit in a backpack, the product must be stripped naked and new technology must be developed to radically improve efficiency. This requires radical narrowing, radical reimagining, and radical innovation. It requires less-with-far-less thinking. (And if it doesn’t run on batteries, it should at least have battery backup to deal with rolling blackouts.)

People in the developing world are intelligent, but most cannot read well and have little experience with developed world products. Where the developed world’s solution is picture-based installation instructions, less-with-far-less products for the developing world demand no instructions. For the developing world, the instruction manual is the on button. And this requires serious technology – software algorithms fed by low cost sensors. And the only way it’s possible is by distilling the product to its essence. Algorithms, yes, but algorithms to do only one thing very well. Less-with-far-less.

The developed world makes products with output that requires judgment – multi-colored graphical output that lets the user decide if things went well. Products for the developing world must have binary output – red/green, beep/no-beep. Less-with-far-less. But again, this seemingly lower-level functionality (a green light versus a digital display) actually requires more technology. The product must interpret results and decide if it’s good – much harder than a sexy graphical output that requires interpretation and judgement.

Creating products for the developing world requires different thinking. Instead of adding more functions and features, it’s about creating new technologies that do one thing very well (and nothing more) and do it with super efficiency. Products for the developing world require higher technologies than those for the developed world. And done well, the developed world will buy them. But the crazy thing is, the less-with-far-less products that will be a hit in the developing world will boomerang back and be an even bigger hit in the developed world.

Less With Far Less

We don’t know the question, but the answer is innovation. And with innovation it’s more, more, more. Whether it’s more with less, or a lot more with a little more, it’s always more. It’s bigger, faster, stronger, or bust. It’s an enhancement of what is, or an extrapolation of what we have. Or it’s the best of product one added to product two. But it’s always more.

We don’t know the question, but the answer is innovation. And with innovation it’s more, more, more. Whether it’s more with less, or a lot more with a little more, it’s always more. It’s bigger, faster, stronger, or bust. It’s an enhancement of what is, or an extrapolation of what we have. Or it’s the best of product one added to product two. But it’s always more.

More-on-more makes radical shifts hard because with more-on-more we hold onto all functionality then add features, or we retain all features then multiply output. This makes it hard to let go of constraints, both the fundamental ones – which we don’t even see as constraints because they masquerade as design rules – and the little-known second class constraints – which we can see, but don’t recognize their power to block first class improvements. (Second class constraints are baggage that come with tangential features which stop us from jumping onto new S-curves for the first class stuff.)

To break the unhealthy cycle of more-on-more addition, think subtraction. Take out features and function. Distill to the essence. Decree guilty until proven innocent, and make your marketers justify the addition of every feature and function. Starting from ground zero, ask your marketers, “If the product does just one thing, what should it do?” Write it down as input to the next step.

Next, instead of more-on-more multiplication, think division. Divide by ten the minimum output of your smallest product. (The intent it to rip your engineers and marketers out of the rut that is your core product line.) With this fractional output, ask what other technologies can enable the functionality? Look down. Look to little technologies, technologies that you could have never considered at full output. Congratulations. You’ve started on your migration toward with less-with-far-less.

On the surface, less-with-far-less doesn’t seem like a big deal. And at first, folks roll their eyes at the idea of taking out features and de-rating output by ten. But its magic is real. When product performance is clipped, constraints fall by the wayside. And when the product must do far less and constraints are dismissed, engineers are pushed away from known technologies toward the unfamiliar and unreasonable. These unfamiliar technologies are unreasonably small and enable functionality with far less real estate and far less inefficiency. The result is radically reduced cost, size, and weight.

Less-with-far-less enables cost reductions so radical, new markets become viable; it makes possible size and weight reductions so radical, new levels of portability open unimaginable markets; it facilitates power reductions so radical, new solar technologies become viable.

The half-life of constraints is long, and the magic from less-with-far-less builds slowly. Before they can let go of what was, engineers must marinate in the notion of less. But when the first connections are made, a cascade of ideas follow and things spin wonderfully out of control. It becomes a frenzy of ideas so exciting, the problem becomes cooling their jets without dampening their spirit.

Less-with-far-less is not dumbed-down work – engineers are pushed to solve new problems with new technologies. Thermal problems are more severe, dimensional variation must be better controlled, and failure modes are new. In fact, less-with-far-less creates steeper learning curves and demands higher-end technologies and even adolescent technologies.

Our thinking, in the form of constraints, limits our thinking. Less-with-far-less creates the scarcity that forces us to abandon our constraints. Less-with-far-less declares our existing technologies unviable and demands new thinking. And I think that’s just what we need.

Mike Shipulski

Mike Shipulski