The Most Important People in Your Company

When the fate of your company rests on a single project, who are the three people you’d tap to drag that pivotal project over the finish line? And to sharpen it further, ask yourself “Who do I want to lead the project that will save the company?” You now have a list of the three most important people in your company. Or, if you answered the second question, you now have the name of the most important person in your company.

When the fate of your company rests on a single project, who are the three people you’d tap to drag that pivotal project over the finish line? And to sharpen it further, ask yourself “Who do I want to lead the project that will save the company?” You now have a list of the three most important people in your company. Or, if you answered the second question, you now have the name of the most important person in your company.

The most important person in your company is the person that drags the most important projects over the finish line. Full stop.

When the project is on the line, the CEO doesn’t matter; the General Manager doesn’t matter; the Business Leader doesn’t matter. The person that matters most is the Project Manager. And the second and third most important people are the two people that the Project Manager relies on.

Don’t believe that? Well, take a bite of this. If the project fails, the product doesn’t sell. And if the product doesn’t sell, the revenue doesn’t come. And if the revenue doesn’t come, it’s game over. Regardless of how hard the CEO pulls, the product doesn’t launch, the revenue doesn’t come, and the company dies. Regardless of how angry the GM gets, without a product launch, there’s no revenue, and it’s lights out. And regardless of the Business Leader’s cajoling, the project doesn’t cross the finish line unless the Project Manager makes it happen.

The CEO can’t launch the product. The GM can’t launch the product. The Business Leader can’t launch the product. Stop for a minute and let that sink in. Now, go back to those three sentences and read them out loud. No, really, read them out loud. I’ll wait.

When the wheels fall off a project, the CEO can’t put them back on. Only a special Project Manager can do that.

There are tools for project management, there are degrees in project management, and there are certifications for project management. But all that is meaningless because project management is alchemy.

Degrees don’t matter. What matters is that you’ve taken over a poorly run project, turned it on its head, and dragged it across the line. What matters is you’ve run a project that was poorly defined, poorly staffed, and poorly funded and brought it home kicking and screaming. What matters is you’ve landed a project successfully when two of three engines were on fire. (Belly landings count.) What matters is that you vehemently dismiss the continuous improvement community on the grounds there can be no best practice for a project that creates something that’s new to the world. What matters is that you can feel the critical path in your chest. What matters is that you’ve sprinted toward the scariest projects and people followed you. And what matters most is they’ll follow you again.

Project Managers have won the hearts and minds of the project team.

The Project manager knows what the team needs and provides it before the team needs it. And when an unplanned need arises, like it always does, the project manager begs, borrows, and steals to secure what the team needs. And when they can’t get what’s needed, they apologize to the team, re-plan the project, reset the completion date, and deliver the bad news to those that don’t want to hear it.

If the General Manager says the project will be done in three months and the Project Manager thinks otherwise, put your money on the Project Manager.

Project Managers aren’t at the top of the org chart, but we punch above our weight. We’ve earned the trust and respect of most everyone. We aren’t liked by everyone, but we’re trusted by all. And we’re not always understood, but everyone knows our intentions are good. And when we ask for help, people drop what they’re doing and pitch in. In fact, they line up to help. They line up because we’ve gone out of our way to help them over the last decade. And they line up to help because we’ve put it on the table.

Whether it’s IoT, Digital Strategy, Industry 4.0, top-line growth, recurring revenue, new business models, or happier customers, it’s all about the projects. None of this is possible without projects. And the keystone of successful projects? You guessed it. Project Managers.

Image credit – Bernard Spragg .NZ

When It’s Time to Defy Gravity

If you pull hard on your team, what will they do? Will they rebel? Will they push back? Will they disagree? Will they debate? And after all that, will they pull with you? Will the pull for three weeks straight? Will they pull with their whole selves? How do you feel about that?

If you pull hard on your team, what will they do? Will they rebel? Will they push back? Will they disagree? Will they debate? And after all that, will they pull with you? Will the pull for three weeks straight? Will they pull with their whole selves? How do you feel about that?

If you pull hard on your peers, what will they do? Will they engage? Will they even listen? Will they dismiss? And if they dismiss, will you persist? Will you pull harder? And when you pull harder, do they think more of you? And when you pull harder still, do they think even more of you? Do you know what they’ll do? And how do you feel about that?

If you push hard on your leadership, what will they do? Will they ‘lllisten or dismiss? And if they dismiss, will you push harder? When you push like hell, do they like that or do they become uncomfortable, what will you do? Will they dislike it and they become comfortable and thankful you pushed? Whatever they feel, that’s on them. Do you believe that? If not, how do you feel about that?

When you say something heretical, does your team cheer or pelt you with fruit? Do they hang their heads or do they hope you do it again? Whatever they do, they’ve watched your behavior for several years and will influence their actions.

When you openly disagree with the company line, do your peers cringe or ask why you disagree? Do they dismiss your position or do they engage in a discussion? Do they want this from you? Do they expect this from you? Do they hope you’ll disagree when you think it’s time? Whatever they do, will you persist? And how do you feel about that?

When you object to the new strategy, does your leadership listen? Or do they un-invite you to the next strategy session? And if they do, do you show up anyway? Or do they think you’re trying to sharpen the strategy? Do they think you want the best for the company? Do they know you’re objecting because everyone else in the room is afraid to? What they think of your dissent doesn’t matter. What matters is your principled behavior over the last decade.

If there’s a fire, does your team hope you’ll run toward the flames? Or, do they know you will?

If there’s a huge problem that everyone is afraid to talk about, do your peers expect you get right to the heart of it? Or, do they hope you will? Or, do they know you will?

If it’s time to defy gravity, do they know you’re the person to call?

And how do you feel about that?

Image credit – The Western Sky

The Giving Cycle

The best gifts are the ones that demonstrate to the recipients that you understand them. You understand what they want; you understand their size (I’m and men’s large); you understand their favorite color; you know what they already have; you know what they’re missing, and you know what they need.

The best gifts are the ones that demonstrate to the recipients that you understand them. You understand what they want; you understand their size (I’m and men’s large); you understand their favorite color; you know what they already have; you know what they’re missing, and you know what they need.

On birthdays and holidays, everyone knows it’s time to give gifts and this makes it easy for us to know them for what they are. And, just to make sure everyone knows the gift is a gift, we wrap them in colorful paper or place them in a fancy basket and formally present them. But gifts given at work are different.

Work isn’t about birthdays and holidays, it’s about the work. There’s no fixed day or date to give them. And there’s no expectation that gifts are supposed to be given. And gifts given at work are not the type that can be wrapped in colorful paper. In that way, gifts given at work are rare. And when they are given, often they’re not recognized as gifts.

The gift of a challenge. When you give someone a challenge, that’s a gift. Yes, the task is difficult. Yes, the request is unreasonable. Yes, it’s something they’ve never done before. And, yes, you believe they’re up to the challenge. And, yes, you’re telling them they’re worthy of the work. And whether the complete 100% of the challenge or only 5% of it, you praise them. You tell them, Holy sh*t! That was amazing. I gave you an impossible task and you took it on. Most people wouldn’t have even tried and you put your whole self into it. You gave it a go. Wow. I hope you’re proud of what you did because I am. The trick for the giver is to praise.

The gift of support. When you support someone that shouldn’t need it, that’s a gift. When the work is clearly within a person’s responsibility and the situation temporarily outgrows them, and you give them what they need, that’s a gift. Yes, it’s their responsibility. Yes, they should be able to handle it. And, yes, you recognize the support they need. Yes, you give them support in a veiled way so that others don’t recognize the gift-giving. And, yes, you do it in a way that the receiver doesn’t have to acknowledge the support and they can save face. The trick for the giver is to give without leaving fingerprints.

The gift of level 2 support. When you give the gift of support defined above and the gift is left unopened, it’s time to give the gift of level 2 support. Yes, you did what you could to signal you left a gift on their doorstep. Yes, they should have seen it for what it was. And, yes, it’s time to send a level 2 gift to their boss in the form of an email sent in confidence. Tell their boss what you tried to do and why you tried to do it. And tell them the guidance you tried to give. This one is called level 2 giving because two people get gifts and because it’s higher-level giving. The trick for the giver is to give in confidence and leave no fingerprints.

The gift of truth. When you give someone the truth of the situation when you know they don’t want to hear it, that’s a gift. Yes, they misunderstand the situation. Yes, it’s their responsibility to understand it. Yes, they don’t want your gift of truth. And, yes, you give it to them because they’re off-track. Yes, you give it to them because you care about them. And, yes you give the gift respectfully and privately. You don’t give a take-it-or-leave-it ultimatum. And you don’t make the decision for them. You tell them why you see it differently and tell them you hope they see your gift as it was intended – as a gift. The trick for the giver is to give respectfully and be okay whether the gift is opened or not.

The gift of forgiveness. When someone has mistreated you or hurt you, and you help them anyway, that’s a gift. Yes, they need help. Yes, the pain is still there. And, yes, you help them anyway. They hurt you because of the causes and conditions of their situation. It wasn’t personal. They would have treated anyone that way. And, yes, this is the most difficult gift to give. And that’s why it’s last on the list. And the trick for the giver is to feel the hurt and give anyway. It will help the hurt go away.

It may not seem this way, but the gifts are for the giver. Givers grow by giving. And best of all for the givers, they get to watch as their gifts grow getters into givers. And that’s magical. And that brings joy.

And the giving cycle spirals on.

Image credit – KTIQS.LCV

Love Everyone and Tell the Truth

If you see someone doing something that’s not quite right, you have a choice – call them on their behavior or let it go.

If you see someone doing something that’s not quite right, you have a choice – call them on their behavior or let it go.

In general, I have found it’s more effective to ignore behavior you deem unskillful if you can. If no one will get hurt, say nothing. If it won’t start a trend, ignore it. And if it’s a one-time event, look the other way. If it won’t cause standardization on a worst practice, it never happened.

When you don’t give attention to other’s unskillful behavior, you don’t give it the energy it needs to happen again. Just as a plant dies when it’s not watered, unskillful behavior will wither on the vine if it’s ignored. Ignore it and it will die. But the real reason to ignore unskillful behavior is that it frees up time to amplify skillful behavior.

If you’re going to spend your energy doing anything, reinforce skillful behavior. When you see someone acting skillfully, call it out. In front of their peers, tell them what you liked and why you liked it. Tell them how their behavior will make a difference for the company. Say it in a way that others hear. Say it in a way that everyone knows this behavior is special. And if you want to guarantee that the behavior will happen again, send an email of praise to the boss of the person that did the behavior and copy them on the email. The power of sending an email of praise is undervalued by a factor of ten.

When someone sends your boss an email that praises you for your behavior, how do you feel?

When someone sends your boss an email that praises you for your behavior, will you do more of that behavior or less?

When someone sends your boss an email that praises you for your behavior, what do you think of the person that sent it?

When someone sends your boss an email that praises you for your behavior, will you do more of what the sender thinks important or less?

And now the hard part. When you see someone behaving unskillfully and that will damage your company’s brand, you must call them on their behavior. To have the most positive influence, give your feedback as soon as you see it. In a cause-and-effect way, the person learns that the unskillful behavior results in a private discussion on the negative impact of their behavior. There’s no question in their mind about why the private discussion happened and, because you suggested a more skillful approach, there’s clarity on how to behave next time. The first time you see the unskillful behavior, they deserve to be held accountable in private. They also deserve a clear explanation of the impacts of their behavior and a recipe to follow going forward.

And now the harder part. If, after the private explanation of the unskillful behavior that should stop and the skillful behavior should start, they repeat the unskillful behavior, you’ve got to escalate. Level 1 escalation is to hold a private session with the offender’s leader. This gives the direct leader a chance to intervene and reinforce how the behavior should change. This is a skillful escalation on your part.

And now the hardest part. If, after the private discussion with the direct leader, the unskillful behavior happens again, you’ve got to escalate. Remember, this unskillful behavior is so unskillful it will hurt the brand. It’s now time to transition from private accountability to public accountability. Yes, you’ve got to call out the unskillful behavior in front of everyone. This may seem harsh, but it’s not. They and their direct leader have earned every bit of the public truth-telling that will soon follow.

Now, before going public, it’s time to ask yourself two questions. Does this unskillful behavior rise to the level of neglect? And, does this unskillful behavior violate a first principle? Meaning, does the unskillful behavior undermine a fundamental, or foundational element, of how the work is done? Take your time with these questions, because the situation is about to get real. Really real. And really uncomfortable.

And if you answer yes to one of those two questions, you’ve earned the right to ask yourself a third. Have you reached bedrock? Meaning, your position grounded deeply in what you believe. Meaning, you’ve reached a threshold where things are non-negotiable. Meaning, no matter what the negative consequences to your career, you’re willing to stand tall and take the bullets. Because the bullets will fly.

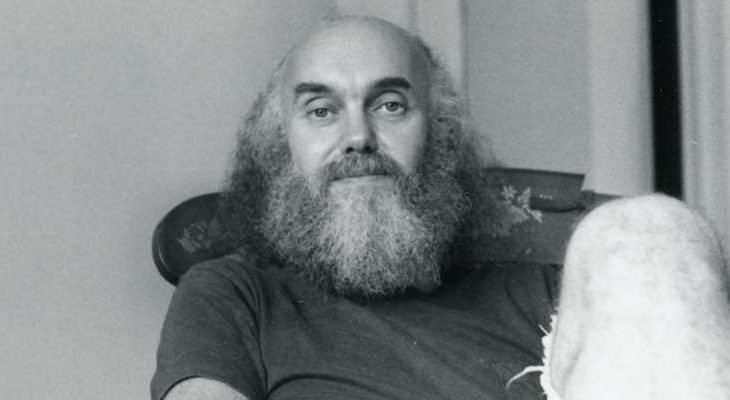

If you’ve reached bedrock, call out the unskillful behavior publicly and vehemently. Show no weakness and give no ground. And when the push-back comes, double down. Stand on your bedrock, and tell the truth. Be effective, and tell the truth. As Ram Dass said, love everyone and tell the truth.

If you want to make a difference, amplify skillful behavior. Send emails of praise. And if that doesn’t work, send more emails of praise. Praise publicly and praise vehemently. Pour gasoline on the fire. And ignore unskillful behavior, when you can.

And when you can’t ignore the unskillful behavior, before going public make sure the behavior violates a first principle. And make sure you’re standing on bedrock. And once you pass those tests, love everyone and tell the truth.

Image credit — RamDass.org

Learn to Recognize Waiting

If you want to do a task, but you don’t have what you need, that’s waiting for a support resource. If you need a tool, but you don’t have it, you wait for a tool. If you need someone to do the task, but you don’t have anyone, you wait for people. If you need some information to make a decision, but you don’t have it, you wait for information.

If a tool is expensive, usually you have to wait for it. The thinking goes like this – the tool is expensive, so let’s share the cost over too many projects and too many teams. Sure, less work will get done, but when we run the numbers, the tool will look less expensive because it’s used by many people. If you see a long line of people (waiting) or a signup list (people waiting at their desks), what they are waiting for is usually an expensive tool or resource. In that way, to find the cause of waiting, stand at the front of the line and look around. What you see is the cause of the waiting.

If the tool isn’t expensive, buy another one and reduce the waiting. If the tool is expensive, calculate the cost of delay. Cost of delay is commonly used with product development projects. If the project is delayed by a month, the incremental revenue from the product launch is also delayed by a month. That incremental revenue is the cost of delaying the project by a month. When the cost of delay is larger than the cost of an expensive tool, it makes sense to buy another expensive tool. But, to purchase that expensive tool requires multiple levels of approvals. So, the waiting caused by the tool results in waiting for approval for the new tool. I guess there’s a cost of delay for the approval process, but let’s not go there.

Most companies have more projects than people, and that’s why projects wait. And when projects wait, projects are late. Adding people is like getting another expensive tool. They are spread over too many projects, and too little gets done. And like with expensive tools, getting more people doesn’t come easy. New hires can be justified (more waiting in the approval queue), but that takes time to find them, hire them, and train them. Hiring temporary people is a good option, though that can seem too expensive (higher hourly rate), it requires approval, and it takes time to train them. Moving people from one project to another is often the best way because it’s quick and the training requirement is less. But, when one project gains a person, another project loses one. And that’s often the rub.

When it’s time to make an important decision and the team has to wait for missing information, the project waits. And when projects wait, projects are late. It’s difficult to see the waiting caused by missing or uncommunicated information, but it can be done. The easiest to see when the information itself is a project deliverable. If a milestone review requires a formal presentation of the information, the review cannot be held without it. The delay of the milestone review (waiting) is objective evidence of missing information.

Information-based waiting is relatively easy to see when the missing information violates a precedent for decision making. For example, if the decision is always made with a defined set of data or information, and that information is missing, the precedent is violated and everyone knows the decision cannot be made. In this case, everyone’s clear why the decision cannot be made, everyone’s clear on what information is missing, and everyone’s clear on who dropped the ball.

It’s most difficult to recognize information-based waiting when the decision is new or different and requires judgment because there’s no requirement for the data and there’s no precedent to fall back on. If the information was formally requested and linked to the decision, it’s clear the information is missing and the decision will be delayed. But if it’s a new situation and there’s no agreement on what information is required for the decision, it’s almost impossible to discern if the information is missing. In this situation, it comes down to trust in the decision-maker. If you trust the decision-maker and they say there’s information missing, then there’s information missing. If you trust the decision-maker and they say there’s no information missing, they should make the decision. But if you don’t trust the decision-maker, then all bets are off.

In general, waiting is bad. And it’s helpful if you can recognize when projects are waiting. Waiting is especially bad went the delayed task is on the critical path because when the project is waiting on a task that’s on the critical path, there’s a day-for-day slip in the completion date. Hint: it’s important to know which tasks and decisions are on the critical path.

Image credit — Tomasz Baranowski

Stop, Start, Continue the Hard Way

The stop, start, continue method (SSC) is a simple, yet powerful, way to plan your day, week and year. And though it’s simple, it’s not simplistic. And though it looks straightforward, it’s onion-like in its layers.

The stop, start, continue method (SSC) is a simple, yet powerful, way to plan your day, week and year. And though it’s simple, it’s not simplistic. And though it looks straightforward, it’s onion-like in its layers.

Stop, start, continue (SSC) is interesting in that it’s forward-looking, present-looking, and rearward-looking at the same time. And its power comes from the requirement that the three time perspectives must be reconciled with each other. Stopping is easy, but what will start? Starting is easy, unless nothing is stopped. Continuing is easy, but it’s not the right thing if the rules have changed. And starting can’t start if everything continues.

Stop. With SSC, stopping is the most important part. That’s why it’s first in the sequence. When everyone’s plates are full and every meeting is an all-you-can-eat buffet, without stopping, all the new action items slathered on top simply slip off the plate and fall to the floor. And this is double trouble because while it’s clear new action items are assigned, there’s no admission that the carpet is soiled with all those recently added action items.

Here’s a rule: If you don’t stop, you can’t start.

And here’s another: Pros stop, and rookies start.

With continuous improvement, you should stop what didn’t work. But with innovation, you should stop what was successful. Let others fan the flames of success while you invent the new thing that will start a bigger blaze.

Start. With SSC, starting is the easy part, but it shouldn’t be. Resources are finite, but we conveniently ignore this reality so we can start starting. The trouble with starting is that no one wants to let go of continuing. Do everything you did last year and start three new initiatives. Continue with your current role, but start doing the new job so you can get the promotion in three years.

Here’s a rule: Starting must come at the expense of continuing.

And here’s another: Pros do stop, start, continue, and rookies do start, start, start.

Continue. With SSC, continue is underrated. If you’re always starting, it’s because you have nothing good to continue. And if you’ve got a lot of continuing to do, it’s because you’ve got a lot of good things going on. And continuing is efficient because you’re not doing something for the first time. And everyone knows how to do the work and it goes smoothly.

But there’s a dark side to continue – it’s called the status quo. The status quo is a powerful, one-trick pony that only knows how to continue. It hates stopping and blocks all starting. Continuing is the mortal enemy of innovation.

Here’s a rule: Continuing must stop, or starting can’t start.

And here’s another: Pros continue and stop before they start, and rookies start.

SSC is like juggling three balls at once. Just as it’s not juggling unless it’s three balls at the same time, it’s not SSC unless it’s stop, start, continue all done at the same time. And just as juggling two balls at once isn’t juggling, it’s not SSC if it’s just two out of the three. And just as dropping two of the three balls on the floor isn’t juggling, it’s not SSC if it’s starting, starting, starting.

Image credit – kosmolaut

A Recipe to Grow Talent

Do it for them, then explain. When the work is new for them, they don’t know how to do it. You’ve got to show them how to do it and explain everything. Tell them about your top-level approach; tell them why you focus on the new elements; show them how to make the chart that demonstrates the new one is better than the old one. Let them ask questions at every step. And tell them their questions are good ones. Praise them for their curiosity. And tell them the answers to the questions they should have asked you. And tell them they’re ready for the next level.

Do it for them, then explain. When the work is new for them, they don’t know how to do it. You’ve got to show them how to do it and explain everything. Tell them about your top-level approach; tell them why you focus on the new elements; show them how to make the chart that demonstrates the new one is better than the old one. Let them ask questions at every step. And tell them their questions are good ones. Praise them for their curiosity. And tell them the answers to the questions they should have asked you. And tell them they’re ready for the next level.

Do it with them, and let them hose it up. Let them do the work they know how to do, you do all the new work except for one new element, and let them do that one bit of new work. They won’t know how to do it, and they’ll get it wrong. And you’ve got to let them. Pretend you’re not paying attention so they think they’re doing it on their own, but pay deep attention. Know what they’re going to do before they do it, and protect them from catastrophic failure. Let them fail safely. And when then hose it up, explain how you’d do it differently and why you’d do it that way. Then, let them do it with your help. Praise them for taking on the new work. Praise them for trying. And tell them they’re ready for the next level.

Let them do it, and help them when they need it. Let them lead the project, but stay close to the work. Pretend to be busy doing another project, but stay one step ahead of them. Know what they plan to do before they do it. If they’re on the right track, leave them alone. If they’re going to make a small mistake, let them. And be there to pick up the pieces. If they’re going to make a big mistake, casually check in with them and ask about the project. And, with a light touch, explain why this situation is different than it seems. Help them take a different approach and avoid the big mistake. Praise them for their good work. Praise them for their professionalism. And tell them they’re ready for the next level.

Let them do it, and help only when they ask. Take off the training wheels and let them run the project on their own. Work on something else, and don’t keep track of their work. And when they ask for help, drop what you are doing and run to help them. Don’t walk. Run. Help them like they’re your family. Praise them for doing the work on their own. Praise them for asking for help. And tell them they’re ready for the next level.

Do the new work for them, then repeat. Repeat the whole recipe for the next level of new work you’ll help them master.

Image credit — John Flannery

Strategy, Tactics, and Action

When it comes to strategy and tactics, there are a lot of definitions, a lot of disagreement, and a whole lot of confusion. When is it strategy? When is it tactics? Which is more important? How do they inform each other?

Instead of definitions and disagreement, I want to start with agreement. Everyone agrees that both strategy AND tactics are required. If you have one without the other, it’s just not the same. It’s like with shoes and socks: Without shoes, your feet get wet; without socks, you get blisters; and when you have both, things go a lot better. Strategy and tactics work best when they’re done together.

The objective of strategy and tactics is to help everyone take the right action. Done well, everyone from the board room to the trenches knows how to take action. In that way, here are some questions to ask to help decide if your strategy and tactics are actionable.

What will we do? This gets to the heart of it. You’ve got to be able to make a list of things that will get done. Real things. Real actions. Don’t be fooled by babble like “We will provide customer value” and “Will grow the company by X%.” Providing customer value may be a good idea, but it’s not actionable. And growing the company by an arbitrary percentage is aspirational, but not actionable.

Why will we do it? This one helps people know what’s powering the work and helps them judge whether their actions are in line with that forcing function. Here’s a powerful answer: Competitors now have products and services that are better than ours, and we can’t have that. This answer conveys the importance of the work and helps everyone put the right amount of energy into their actions. [Note: this question can be asked before the first one.]

Who will do it? Here’s a rule: if no one is freed up to do the new work, the new work won’t get done. Make a list of the teams that will stop their existing projects before they can take action on the new work. Make a list of the new positions that are in the budget to support the strategy and tactics. Make a list of the new companies you’ll partner with. Make a list of all the incremental funding that has been put in the budget to help all the new people complete all these new actions. If your lists are short or you can make any, you don’t have what it takes to get the work done. You don’t have a strategy and you don’t have tactics. You have an unfunded mandate. Run away.

When will it be done? All actions must have completion dates. The dates will be set without consideration of the work content, so they’ll be wrong. Even still, you should have them. And once you have the dates, double all the task durations and push out the dates in your mind. No need to change the schedule now (you can’t change it anyway) because it will get updated when the work doesn’t get done on time. Now, using your lists of incremental headcount and budget, assign the incremental resources to all the actions with completion dates. Look for actions and budgets as those are objective evidence of the unfunded mandate character of your strategy and tactics. And for actions without completion dates, disregard them because they can never be late.

How will we know it’s done? All actions must call out a definition of success (DOS) that defines when the action has been accomplished. Without a measurable DOS, no one is sure when they’re done so they’ll keep working until you stop them. And you don’t want that. You want them to know when they’re done so they can quickly move on to the next action without oversight. If there’s no time to create a DOS, the action isn’t all that important and neither is the completion date.

When the wheels fall off, and they will, how will we update the strategy and tactics? Strategy and tactics are forward-looking and looking forward is rife with uncertainty. You’ll be wrong. What actions will you take to see if everything is going as planned? What actions will you take when progress doesn’t meet the plan? What actions will you take when you learn your tactics aren’t working and your strategy needs a band-aid? What will you do? Who will do it? When will it be done? And how will you know it’s done?

Image credit: Eric Minbiole

What it Takes to Do New Work

What it takes to do new work.

Confidence to get it wrong and confidence to do it early and often.

Purposeful misuse of worst practices in a way that makes them the right practices.

Tolerance for not knowing what to do next and tolerance for those uncomfortable with that.

Certainty that they’ll ask for a hard completion date and certainty you won’t hit it.

Knowledge that the context is different and knowledge that everyone still wants to behave like it’s not.

Disdain for best practices.

Discomfort with success because it creates discomfort when it’s time for new work.

Certainty you’ll miss the mark and certainty you’ll laugh about it next week.

Trust in others’ bias to do what worked last time and trust that it’s a recipe for disaster.

Belief that successful business models have half-lives and belief that no one else does.

Trust that others will think nothing will come of the work and trust that they’re likely right.

Image credit — japanexpertna.se

The Toughest Word to Say

As the world becomes more connected, it becomes smaller. And as it becomes smaller, competition becomes more severe. And as competition increases, work becomes more stressful. We live in a world where workloads increase, timelines get pulled in, metrics multiply and “accountability” is always the word of the day. And in these trying times, the most important word to say is also the toughest.

As the world becomes more connected, it becomes smaller. And as it becomes smaller, competition becomes more severe. And as competition increases, work becomes more stressful. We live in a world where workloads increase, timelines get pulled in, metrics multiply and “accountability” is always the word of the day. And in these trying times, the most important word to say is also the toughest.

When your plate is full and someone tries to pile on more work, what’s the toughest word to say?

When the project is late and you’re told to pull in the schedule and you don’t get any more resources, what’s the toughest word to say?

When the technology you’re trying to develop is new-to-world and you’re told you must have it ready in three months, what’s the toughest word to say?

When another team can’t fill an open position and they ask you to fill in temporarily while you do your regular job, what’s the toughest word to say?

When you’re asked to do something that will increase sales numbers this quarter at the expense of someone else’s sales next quarter, what’s the toughest word to say?

When you’re told to use a best practice that isn’t best for the situation at hand, what’s the toughest word to say?

When you’re told to do something and how to do it, what’s the toughest word to say?

When your boss asks you something that you know is clearly their responsibility, what’s the toughest word to say?

Sometimes the toughest word is the right word.

Image credit –Noirathse’s Eye

28 Things I Learned the Hard Way

- If you want to have an IoT (Internet of Things) program, you’ve got to connect your products.

- If you want to build trust, give without getting.

- If you need someone with experience in manufacturing automation, hire a pro.

- If the engineering team wants to spend a year playing with a new technology, before the bell rings for recess ask them what solution they’ll provide and then go ask customers how much they’ll pay and how many they’ll buy.

- If you don’t have the resources, you don’t have a project.

- If you know how it will turn out, let someone else do it.

- If you want to make a friend, help them.

- If your products are not connected, you may think you have an IoT program, but you have something else.

- If you don’t have trust, you have just what you earned.

- If you hire a pro in manufacturing automation, listen to them.

- If Marketing has an optimistic sales forecast for the yet-to-be-launched product, go ask customers how much they’ll pay and how many they’ll buy.

- If you don’t have a project manager, you don’t have a project.

- If you know how it will turn out, teach someone else how to do it.

- If a friend needs help, help them.

- If you want to connect your products at a rate faster than you sell them, connect the products you’ve already sold.

- If you haven’t started building trust, you started too late.

- If you want to pull in the delivery date for your new manufacturing automation, instead, tell your customers you’ve pushed out the launch date.

- If the VP knows it’s a great idea, go ask customers how much they’ll pay and how many they’ll buy.

- If you can’t commercialize, you don’t have a project.

- If you know how it will turn out, do something else.

- If a friend asks you twice for help, drop what you’re doing and help them immediately.

- If you can’t figure out how to make money with IoT, it’s because you’re focusing on how to make money at the expense of delivering value to customers.

- If you don’t have trust, you don’t have much

- If you don’t like extreme lead times and exorbitant capital costs, manufacturing automation is not for you.

- If the management team doesn’t like the idea, go ask customers how much they’ll pay and how many they’ll buy.

- If you’re not willing to finish a project, you shouldn’t be willing to start.

- If you know how it will turn out, it’s not innovation.

- If you see a friend that needs help, help them ask you for help.

Image credit — openDemocracy

Mike Shipulski

Mike Shipulski