Archive for the ‘Product Development’ Category

Don’t bankrupt your suppliers – get Design Engineers involved.

Cost Out, Cost Down, Cost Reduction, Should Costing – you’ve heard about these programs. But they’re not what they seem. Under the guise of reducing product costs they steal profit margin from suppliers. The customer company increases quarterly profits while the supplier company loses profits and goes bankrupt. I don’t like this. Not only is this irresponsible behavior, it’s bad business. The savings are less than the cost of qualifying a new supplier. Shortsighted. Stupid.

Cost Out, Cost Down, Cost Reduction, Should Costing – you’ve heard about these programs. But they’re not what they seem. Under the guise of reducing product costs they steal profit margin from suppliers. The customer company increases quarterly profits while the supplier company loses profits and goes bankrupt. I don’t like this. Not only is this irresponsible behavior, it’s bad business. The savings are less than the cost of qualifying a new supplier. Shortsighted. Stupid.

The real way to do it is to design out product cost, to reduce the cost signature. Margin is created and shared with suppliers. Suppliers make more money when it’s done right. That’s right, I said more money. More dollars per part, and not more from the promise of increased sales. (Suppliers know that’s bullshit just as well as you, and you lose credibility when you use that line.) The Design Engineering community are the only folks that can pull this off.

Only the Design Engineers can eliminate features that create cost while retaining features that control function. More function, less cost. More margin for all. The trick: how to get Design Engineers involved.

There is a belief that Design Engineers want nothing to do with cost. Not true. Design Engineers would love to design out cost, but our organization doesn’t let us, nor do they expect us to. Too busy; too many products to launch; designing out cost takes too long. Too busy to save 25% of your material cost? Really? Run the numbers – material cost times volume times 25%. Takes too long? No, it’s actually faster. Manufacturing issues are designed out so the product hits the floor in full stride so Design Engineers can actually move onto designing the next product. (No one believes this.)

Truth is Design Engineers would love to design products with low cost signatures, but we don’t know how. It’s not that it’s difficult, it’s that no one ever taught us. What the Design Engineers need is an investment in the four Ts – tools, training, time, and a teacher.

Run the numbers. It’s worth the investment.

Material cost x Volume x 25%

Anyone want to save $50 billion?

I read a refreshing article in the Washington Post. Defense Secretary Robert M. Gates wants to save $20B per year on the Pentagon’s spend. I could kiss this guy!

I read a refreshing article in the Washington Post. Defense Secretary Robert M. Gates wants to save $20B per year on the Pentagon’s spend. I could kiss this guy!

Gates wants contracts scrutinized more closely for inefficiencies and unneeded overhead. He said the savings could be shifted to support U.S. troops around the globe. Pentagon officials said they’re looking for annual savings in the $400 billion spent on goods and services. They’re looking to save $20B, or 5%.

Gates has it right. The government must stop overpaying. But how? Gates suggests improved contract scrutiny to eliminate inefficiencies and unneeded overhead. He’s on the right track, but that’s not where the money is. Gates’ real target should be material cost – that’s where the money is. But, can material cost bring $20B savings? Yes.

Assume the Pentagon spends $100B on services and $300B on goods. The cost of those of goods falls into three buckets: labor, material, and overhead, where material cost makes up the lion’s share at 70%, or $210B. A 10% reduction in material cost brings $21B in savings, and gets Gates to his target. But how?

To get the savings, the Pentagon must drive the right behavior. They must must make suppliers submit a “should cost” with all proposals. The should cost is an estimated cost based on part geometries, materials, manufacturing processes used to create the parts, prevailing wage rates and machine rates, and profit. From these parameters, a should cost can be created in the design phase, without actually making the parts. So, the Pentagon will know what they should pay before the product is made. This cost analysis is based on real data, real machines, and real material costs. There is no escape for defense contractors. The cash cow is no longer.

Should costing will drive the design engineers to create designs that work better and cost less, something the defense industry thinks is impossible. They’re wrong. Given the tools, time, and training, the defense industry’s design engineering community can design out at least 25% of material cost, resulting in $50B+ in savings, more than twice Gates’ goal. Someone just has to teach them how.

Mr. Secretary, the non-defense world is ready to help. Just ask us. (But we’ll go after a 50% cost reduction.)

Back to Basics with DFMA

About eight years ago, Hypertherm embarked on a mission to revamp the way it designed products. Despite the fact its plasma metal-cutting technology was highly regarded and the market leader in the field, the internal consensus was that product complexity could be reduced and thus made more consistently reliable, and there was an across-the-board campaign to reduce product development and manufacturing costs. Instead of entailing novel engineering tactics or state-of-the-art process change, it was a back-to-basics strategy around design for manufacture and assembly (DFMA) that propelled Hypertherm to meet its goals.

About eight years ago, Hypertherm embarked on a mission to revamp the way it designed products. Despite the fact its plasma metal-cutting technology was highly regarded and the market leader in the field, the internal consensus was that product complexity could be reduced and thus made more consistently reliable, and there was an across-the-board campaign to reduce product development and manufacturing costs. Instead of entailing novel engineering tactics or state-of-the-art process change, it was a back-to-basics strategy around design for manufacture and assembly (DFMA) that propelled Hypertherm to meet its goals.

The first step in the redesign program was determining what needed to change. A steering committee with representation from engineering, manufacturing, marketing, and business leadership spent weeks trying to determine what was required from a product standpoint to deliver radical improvements in both product performance and product economics. As a result of that collaboration, the team established aggressive new targets around robustness and reliability in addition to the goal of cutting the parts count and labor costs nearly in half.

Ready, Fire, Aim.

Pent up demand is everywhere. After almost two years of cutting inventories and pushing out purchases, companies are ready to buy. And with credit coming back on line, they’re ready to buy in bulk. Good news? No, great news. We’re back on our growth path. And that’s good because Wall Street now expects growth. But, together this wicked couple of pent up demand and Wall Street’s appetite for immediate growth has created a powder keg that’s ready to blow.

Pent up demand is everywhere. After almost two years of cutting inventories and pushing out purchases, companies are ready to buy. And with credit coming back on line, they’re ready to buy in bulk. Good news? No, great news. We’re back on our growth path. And that’s good because Wall Street now expects growth. But, together this wicked couple of pent up demand and Wall Street’s appetite for immediate growth has created a powder keg that’s ready to blow.

Companies want more new products to satisfy the pent up demand (and Wall Street). Growth through new products is a theme heard around the globe; there’s a relentless push for more products – early and often. Resources be damned, best practices be damned, we’re going to launch more products. Were going to market and will fix it later. The battle cry – Don’t launch, don’t sell!. However, the real battle cry is more aptly – Ready, fire, aim! We’re going too fast.

I’m all for productivity, but we’re heading for a cliff, a cliff some have already accelerated off of, albeit in an unintended way.

a

We’ve forgotten the golden rule – provide value to customers, or you’re hosed.

a

Customers value function, or “what it does”. Function first. But in this need-for-speed environment that’s just what’s at risk. To reduce time to market, we eliminate tasks (best practices?) in our product development processes. All good unless we eliminate tasks that make the product function as intended. All good unless we load our engineers so heavily they don’t have time to design in functionality. We must be careful here. If you’re first to market and your product doesn’t work, you should have waited.

I believe launching too early is worse than launching too late because a botched launch can damage your brand, the brand you’ve taken years to build. (Click this link to see a post on brand damaging.) As we know, word gets around when your product doesn’t work (or accelerates on its own).

Satisfying the siren of pent up demand can run you into the rocks if you’re not careful. So block your ears to her song, and take the time to get your products right.

Custom Model, exploring customized manufacturing (Mechanical Engineering Magazine)

By reducing parts count and easing assembly, one plasma cutter maker explores customized manufacturing.

By reducing parts count and easing assembly, one plasma cutter maker explores customized manufacturing.

By Jean Thilmany, Associate Editor, Mechanical Engineering Magazine

Ask nearly any engineer or manufacturer about customized manufacturing and—to a person—they’ll all say the same thing: Have you heard the Dell story?

Dell is offered up again and again as the number one example of customized manufacturing done right and done successfully. Shortly after its founding in 1984, Dell began what it calls a configure-to-order approach to manufacturing. The computer company lets customers customize their own computers on the Dell Web site. Buyers select how much memory and disk space they desire and the resulting computer is manufactured and shipped to them.

The approach has helped the computer maker see skyrocket growth. Last year, it held the second-highest spot for desktops and laptops shipped, behind Hewlett Packard, according to market-share numbers from research firm International Data Corp. in Framingham, Mass.

Manufacturers—particularly electronics manufacturers—have long been taking notice. Many of them are investigating how the configure-to-order model could be put to use at their own companies. And some of them have implemented the method—along with the necessary software to get the job done—with great success.

Take Hypertherm Inc. of Hanover, N.H., maker of plasma metal cutting equipment. The company has recently started allowing customers to choose online from ten CNC Edge Pro product configurations, up from three configurations in the former product line, said John Sobr, head designer on the project.

Hypertherm recently redesigned its plasma metal cutting equipment to reduce part count by 27 percent while doubling the number of inputs available. Customers can now choose from ten product configurations.

DFMA Won’t Work

Ask a company or team to do DFMA, and you get a great list of excuses on why DFMA is not applicable and won’t work. Product volumes are too low for DFMA, or too high; product costs are too low, or too high; production processes are too simple, or complex; production mix is too low, or too high. That’s all crap – just excuses to get out of doing the work. DFMA is applicable; it’s just a question of how to prioritize the work.

Ask a company or team to do DFMA, and you get a great list of excuses on why DFMA is not applicable and won’t work. Product volumes are too low for DFMA, or too high; product costs are too low, or too high; production processes are too simple, or complex; production mix is too low, or too high. That’s all crap – just excuses to get out of doing the work. DFMA is applicable; it’s just a question of how to prioritize the work.

To prioritize the work, take a look at product volumes. They’ll put you in the right ballpark. Here are three categories, low, medium, and high volume:

DFMA to Control Controller Design – Design2Part Magazine

Design for Manufacture and Assembly is reported to improve CNC performance, modularity, durability, and serviceability

When Hypertherm (www.hypertherm.com) was getting ready to design its next generation of metal cutting CNCs, the engineering team’s goal was to make improvements. But the controllers, which automate the Hanover, New Hampshire-based company’s advanced cutting tools and systems, were already well-accepted in the marketplace and highly regarded in the industry. So why redesign? And how would they go about it?

See this link for the full article – Using DFMA to Control Controller Design

Discontinuous Improvement at the Expense of Continuous Improvement

Five percent here, three percent there. I’m tired as hell of continuous improvement. Sure there’s a place for it, but it shouldn’t be the only type of work we do. But, unfortunately, that’s just what’s happened in manufacturing. To secure the balance sheet, the pendulum swung too far toward continuous improvement. Just look at what we’re writing about – the next low cost country, shorter lead times, how to be profitable where there’s no profit to be had. Those topics scream continuous improvement – take nickels and dimes out of processes to increase profits. But there’s a dark side to all this focus on continuous improvement. It has created a big problem: it has come at the expense of discontinuous improvement.

Five percent here, three percent there. I’m tired as hell of continuous improvement. Sure there’s a place for it, but it shouldn’t be the only type of work we do. But, unfortunately, that’s just what’s happened in manufacturing. To secure the balance sheet, the pendulum swung too far toward continuous improvement. Just look at what we’re writing about – the next low cost country, shorter lead times, how to be profitable where there’s no profit to be had. Those topics scream continuous improvement – take nickels and dimes out of processes to increase profits. But there’s a dark side to all this focus on continuous improvement. It has created a big problem: it has come at the expense of discontinuous improvement.

Continuous improvement is a philosophy of minimization with a focus on cost and waste reduction, while discontinuous improvement is a philosophy of maximization with a focus on creation of new markets through product innovation. As of late, we’ve minimized waste at the expense of invention and innovation. I propose we flip this on its head and maximize through discontinuous improvement at the expense of continuous improvement. That’s right; I said do less lean and Six Sigma.

But we must ask ourselves if we’re capable of doing discontinuous improvement. Remember, we ignored or dismantled our innovation engines over the last years. And what about our big thinkers, our creative thinkers, our innovators? Do they still work for us, or have they just stopped talking about big ideas? I urge you to answer that question because your next actions depend on it.

If your innovative thinkers are gone, go out and hire the best you can find ASAP. If you were fortunate enough to retain your big thinkers, congratulations. Now it’s time to get the band back together, but first you’ve got to do some reconnaissance to ferret them out of their hiding places. Once you find them, invite them to a nice lunch – the nicer the better. Don’t push too hard at lunch, just start to get reacquainted. In time you’ll get to talk about their ideas on new technologies and how to create new markets.

It will be difficult to get your company swing the pendulum away from continuous improvement, but you must try. Without discontinuous improvement your company will be destined to wrestle for nickels using lean and Six Sigma.

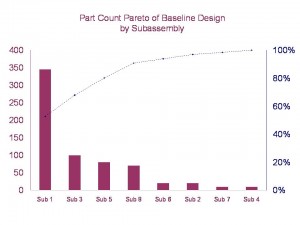

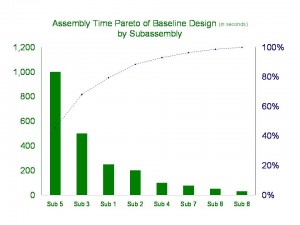

Pareto’s Three Lenses for Product Design

Axiom 1 – Time is short, so make sure you’re working on the most important stuff.

Axiom 1 – Time is short, so make sure you’re working on the most important stuff.

Axiom 2 – You can’t design out what you can’t see.

In product development, these two axioms can keep you out of trouble. They’re two sides of the same coin, but I’ll describe them one at a time and hope it comes together in the end.

With Axiom 1, how do you make sure you’re working on the most important stuff? We all know it’s function first – no learning there. But, sorry design engineers, it doesn’t end with function. You must also design for lean, for cost, and factory floor space. Great. More things to design for. Didn’t you say time was short? How the hell am I going to design for all that?

Now onto the seeing business of Axiom 2. If we agree that lean, cost, and factory floor space are the right stuff, we must “see it” if we are to design it out. See lean? See cost? See factory floor space? You’re nuts. How do you expect us to do that?

Pareto to the rescue – use Pareto charts to identify the most important stuff, to prioritize the work. With Pareto, it’s simple: work on the biggest bars at the expense of the smaller ones. But, Paretos of what?

There is no such thing as a clean sheet design – all new product designs have a lineage. A new design is based on an existing design, a baseline design, with improvements made in several areas to realize more features or better function defined by the product specification. The Pareto charts are created from the baseline design to allow you to see the things to design out (Axiom 2). But what lenses to use to see lean, cost, and factory floor space?

Here are Pareto’s three lenses so see what must be seen:

To lean out lean out your factory, design out the parts. Parts create waste and part count is the surrogate for lean.

To design out cost, measure cost. Cost is the surrogate for cost.

To design out factory floor space, measure assembly time. Since factory floor space scales with assembly time, assembly time is the surrogate for factory floor space.

Now that your design engineers have created the right Pareto charts and can see with the right glasses, they’re ready to focus their efforts on the most important stuff. No boiling the ocean here. For lean, focus on part count of subassembly 1; for cost, focus on the cost of subassemblies 2 and 4; for floor space, focus on assembly time of subassembly 5. Leave the others alone.

Focus is important and difficult, but Pareto can help you see the light.

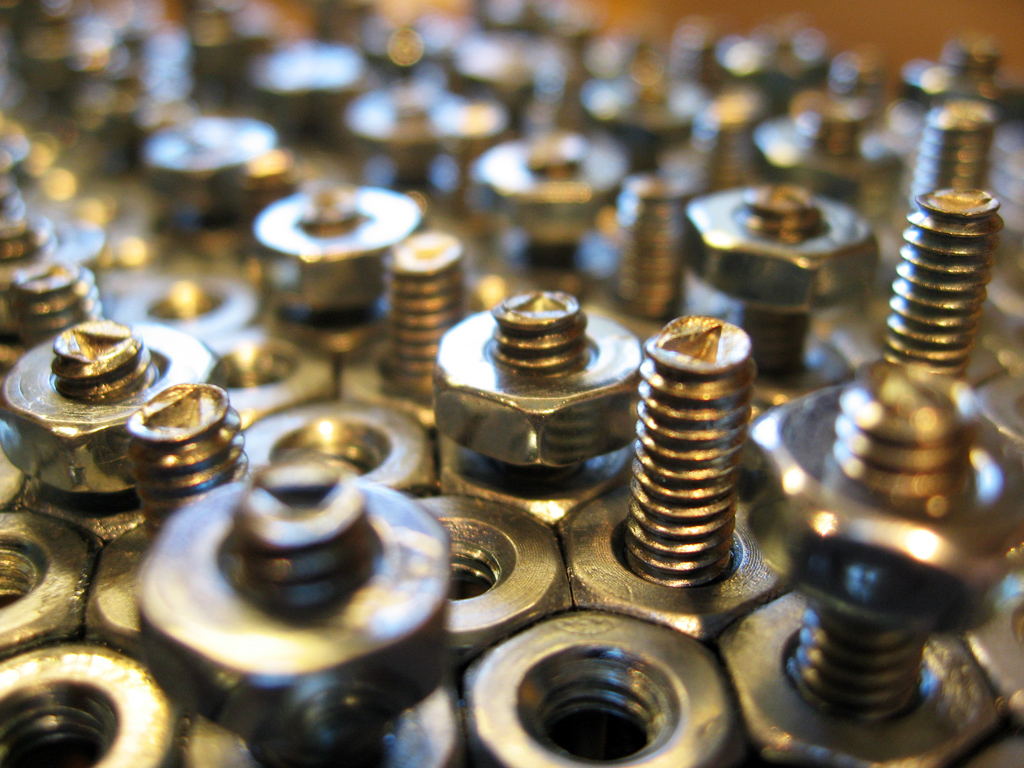

Fasteners Can Consume 20-50% of Assembly Labor

The data-driven people in our lives tell us that you can’t improve what you can’t measure. I believe that. And it’s no different with product cost. Before improving product cost, before designing it out, you have to know where it is. However, it can be difficult to know what really creates cost. Not all parts and features are created equal; some create more cost than others, and it’s often unclear which are the heavy hitters. Sometimes the heavy hitters don’t look heavy, and often are buried deeply within the hidden factory.

The data-driven people in our lives tell us that you can’t improve what you can’t measure. I believe that. And it’s no different with product cost. Before improving product cost, before designing it out, you have to know where it is. However, it can be difficult to know what really creates cost. Not all parts and features are created equal; some create more cost than others, and it’s often unclear which are the heavy hitters. Sometimes the heavy hitters don’t look heavy, and often are buried deeply within the hidden factory.

Measure, measure, measure. That’s what the black belts say. However, it’s difficult to do well with product cost since our costing methods are hosed up and our measurement systems are limited. What do I mean? Consider fasteners (e.g., nuts, bolts, screws, and washers), the product’s most basic life form. Because fasteners are not on the BOM, they’re not part of product cost. Here’s the party line: it’s overhead to be shared evenly across all the products in a socialist way. That’s not a big deal, right? Wrong. Although fasteners don’t cost much in ones and twos, they do add up. 300-500 pieces per unit times the number of units per year makes for a lot of unallocated and untracked cost. However, a more significant issue with those little buggers is they take a lot of time attach to the product. For example, using standard time data from DFMA software, assembly of a 1/4″ nut with a bolt, locktite, a lockwasher, and cleanup takes 50 seconds. That’s a lot of time. You should be asking yourself what that translates to in your product. To figure it out, multiply the number nut/bolt/washer groupings by 50 seconds and multiply the result by the number of units per year. Actually, never mind. You can’t do the calculation because you don’t know the number of nut/bolt/washer combinations that are in your product. You could try to query your BOMs, but the information is likely not there. Remember, fasteners are overhead and not allocated to product. Have you ever tried to do a cost reduction project on overhead? It’s impossible. Because overhead inflicts pain evenly to all, no one is responsible to reduce it.

With fasteners, it’s like death by a thousand cuts.

The time to attach them can be as much as 20-50% of labor. That’s right, up to 50%. That’s like paying 20-50% of your folks to attach fasteners all day. That should make you sick. But it’s actually worse than that. From Line Design 101, the number of assembly stations is proportional to demand times labor time. Since fasteners inflate labor time, they also inflate the number of assembly stations, which, in turn, inflates the factory floor space needed to meet demand. Would you rather design out fasteners or add 15% to your floor space? I know you can get good deals on factory floor space due to the recession, but I’d still rather design out fasteners.

Even with the amount of assembly labor consumed by fasteners, our thinking and computer systems are blind to them and the associated follow-on costs. And because of our vision problems, the design community cannot be held accountable to design out those costs. We’ve given them the opportunity to play dumb and say things like, “Those fastener things are free. I’m not going to spend time worrying about that. It’s not part of the product cost.” Clearly not an enlightened statement, but it’s difficult to overcome without cost allocation data for the fasteners.

The work-around for our ailing thinking and computer-based cost tracking systems is simple: get the design engineers out to the production floor to build the product. Have them experience first hand how much waste is in the product. They’ll come back with a deep-in-the-gut understanding of how things really are. Then, have them use DFMA software to score the existing design, part-by-part, feature-by-feature. I guarantee everyone will know where the cost is after that. And once they know where the cost is, it will be easy for them to design it out.

I have data to support my assertion that fasteners can make up 20-50% of labor time, but don’t take my word for it. Go out to the factory floor, shut your eyes and listen. You’ll likely hear the never ending song of the nut runners. With each chirp, another nut is fastened to its bolt and washer, and another small bit of labor and factory floor space is consumed by the lowly fastener.

Innovation, Technical Risk, and Schedule Risk

There is a healthy tension between level of improvement, or level of innovation, and time to market. Marketing wants radical improvement, infinitely short project schedules, and no change to the product. Engineers want to sign up for the minimum level of improvement, project schedules sufficiently long to study everything to death, and want to change everything about the new product. It’s healthy because there is balance – both are pulling equally hard in opposite directions and things end up somewhere in the middle. It’s not a stress-free environment, but it’s not too bad. But, sometimes the tension is unhealthy.

There are two flavors of unhealthy tension. First is when engineering has too much pull; they (we) sandbag on product performance and project timelines and change the design willy-nilly simply because they can (and it’s fun). The results are long project timelines, highly innovative designs that don’t work well, a lack of product robustness, and a boatload of new parts and assemblies. (Product complexity.) Second is when Marketing has too much pull; they ask for radical improvement in product functionality with project timelines too short for the level of innovation, and tightly constrain product changes such that solutions are not within the constraints. The results are long project timelines and un-innovative designs that don’t meet product specifications. (The solutions are outside the constraints.) Both sides are at fault in both scenarios. There are no clean hands.

What are the fundamentals behind all this gamesmanship? For engineering it’s technical risk; for marketing it’s schedule risk. Engineering minimizes what it signs up for in order to reduce technical risk and petitions for long project timelines to reduce it. Marketing minimizes product changes (constraints) to reduce schedule risk and petitions for short project timelines to reduce it. (Product development teams work harder with short schedules.) Something’s got to change. Read the rest of this entry »

Mike Shipulski

Mike Shipulski