Archive for the ‘Product Development’ Category

The Most Important People in Your Company

When the fate of your company rests on a single project, who are the three people you’d tap to drag that pivotal project over the finish line? And to sharpen it further, ask yourself “Who do I want to lead the project that will save the company?” You now have a list of the three most important people in your company. Or, if you answered the second question, you now have the name of the most important person in your company.

When the fate of your company rests on a single project, who are the three people you’d tap to drag that pivotal project over the finish line? And to sharpen it further, ask yourself “Who do I want to lead the project that will save the company?” You now have a list of the three most important people in your company. Or, if you answered the second question, you now have the name of the most important person in your company.

The most important person in your company is the person that drags the most important projects over the finish line. Full stop.

When the project is on the line, the CEO doesn’t matter; the General Manager doesn’t matter; the Business Leader doesn’t matter. The person that matters most is the Project Manager. And the second and third most important people are the two people that the Project Manager relies on.

Don’t believe that? Well, take a bite of this. If the project fails, the product doesn’t sell. And if the product doesn’t sell, the revenue doesn’t come. And if the revenue doesn’t come, it’s game over. Regardless of how hard the CEO pulls, the product doesn’t launch, the revenue doesn’t come, and the company dies. Regardless of how angry the GM gets, without a product launch, there’s no revenue, and it’s lights out. And regardless of the Business Leader’s cajoling, the project doesn’t cross the finish line unless the Project Manager makes it happen.

The CEO can’t launch the product. The GM can’t launch the product. The Business Leader can’t launch the product. Stop for a minute and let that sink in. Now, go back to those three sentences and read them out loud. No, really, read them out loud. I’ll wait.

When the wheels fall off a project, the CEO can’t put them back on. Only a special Project Manager can do that.

There are tools for project management, there are degrees in project management, and there are certifications for project management. But all that is meaningless because project management is alchemy.

Degrees don’t matter. What matters is that you’ve taken over a poorly run project, turned it on its head, and dragged it across the line. What matters is you’ve run a project that was poorly defined, poorly staffed, and poorly funded and brought it home kicking and screaming. What matters is you’ve landed a project successfully when two of three engines were on fire. (Belly landings count.) What matters is that you vehemently dismiss the continuous improvement community on the grounds there can be no best practice for a project that creates something that’s new to the world. What matters is that you can feel the critical path in your chest. What matters is that you’ve sprinted toward the scariest projects and people followed you. And what matters most is they’ll follow you again.

Project Managers have won the hearts and minds of the project team.

The Project manager knows what the team needs and provides it before the team needs it. And when an unplanned need arises, like it always does, the project manager begs, borrows, and steals to secure what the team needs. And when they can’t get what’s needed, they apologize to the team, re-plan the project, reset the completion date, and deliver the bad news to those that don’t want to hear it.

If the General Manager says the project will be done in three months and the Project Manager thinks otherwise, put your money on the Project Manager.

Project Managers aren’t at the top of the org chart, but we punch above our weight. We’ve earned the trust and respect of most everyone. We aren’t liked by everyone, but we’re trusted by all. And we’re not always understood, but everyone knows our intentions are good. And when we ask for help, people drop what they’re doing and pitch in. In fact, they line up to help. They line up because we’ve gone out of our way to help them over the last decade. And they line up to help because we’ve put it on the table.

Whether it’s IoT, Digital Strategy, Industry 4.0, top-line growth, recurring revenue, new business models, or happier customers, it’s all about the projects. None of this is possible without projects. And the keystone of successful projects? You guessed it. Project Managers.

Image credit – Bernard Spragg .NZ

Innovation isn’t uncertain, it’s unknowable.

Where’s the Marketing Brief? In product development, the Marketing team creates a document that defines who will buy the new product (the customer), what needs are satisfied by the new product and how the customer will use the new product. And Marketing team also uses their crystal ball to estimate the number of units the customers will buy, when they’ll buy it and how much they’ll pay. In theory, the Marketing Brief is finalized before the engineers start their work.

Where’s the Marketing Brief? In product development, the Marketing team creates a document that defines who will buy the new product (the customer), what needs are satisfied by the new product and how the customer will use the new product. And Marketing team also uses their crystal ball to estimate the number of units the customers will buy, when they’ll buy it and how much they’ll pay. In theory, the Marketing Brief is finalized before the engineers start their work.

With innovation, there can be no Marketing Brief because there are no customers, no product and no technology to underpin it. And the needs the innovation will satisfy are unknowable because customers have not asked for the them, nor can the customer understand the innovation if you showed it to them. And how the customers will use the? That’s unknowable because, again, there are no customers and no customer needs. And how many will you sell and the sales price? Again, unknowable.

Where’s the Specification? In product development, the Marketing Brief is translated into a Specification that defines what the product must do and how much it will cost. To define what the product must do, the Specification defines a set of test protocols and their measurable results. And the minimum performance is defined as a percentage improvement over the test results of the existing product.

With innovation, there can be no Specification because there are no customers, no product, no technology and no business model. In that way, there can be no known test protocols and the minimum performance criteria are unknowable.

Where’s the Schedule? In product development, the tasks are defined, their sequence is defined and their completion dates are defined. Because the work has been done before, the schedule is a lot like the last one. Everyone knows the drill because they’ve done it before.

With innovation, there can be no schedule. The first task can be defined, but the second cannot because the second depends on the outcome of the first. If the first experiment is successful, the second step builds on the first. But if the first experiment is unsuccessful, the second must start from scratch. And if the customer likes the first prototype, the next step is clear. But if they don’t, it’s back to the drawing board. And the experiments feed the customer learning and the customer learning shapes the experiments.

Innovation is different than product development. And success in product development may work against you in innovation. If you’re doing innovation and you find yourself trying to lock things down, you may be misapplying your product development expertise. If you’re doing innovation and you find yourself trying to write a specification, you may be misapplying your product development expertise. And if you are doing innovation and find yourself trying to nail down a completion date, you are definitely misapplying your product development expertise.

With innovation, people say the work is uncertain, but to me that’s not the right word. To me, the work is unknowable. The customer is unknowable because the work hasn’t been done before. The specification is unknowable because there is nothing for comparison. And the schedule in unknowable because, again, the work hasn’t been done before.

To set expectations appropriately, say the innovation work is unknowable. You’ll likely get into a heated discuss with those who want demand a Marketing Brief, Specification and Schedule, but you’ll make the point that with innovation, the rules of product development don’t apply.

Image credit — Fatih Tuluk

The Additive Manufacturing Maturity Model

Additive Manufacturing (AM) is technology/product space with ever-increasing performance and an ever-increasing collection of products. There are many different physical principles used to add material and there are a range of part sizes that can be made ranging from micrometers to tens of meters. And there is an ever-increasing collection of materials that can be deposited from water soluble plastics to exotic metals to specialty ceramics.

Additive Manufacturing (AM) is technology/product space with ever-increasing performance and an ever-increasing collection of products. There are many different physical principles used to add material and there are a range of part sizes that can be made ranging from micrometers to tens of meters. And there is an ever-increasing collection of materials that can be deposited from water soluble plastics to exotic metals to specialty ceramics.

But AM tools and technologies don’t deliver value on their own. In order to deliver value, companies must deploy AM to solve problems and implement solutions. But where to start? What to do next? And how do you know when you’ve arrived?

To help with your AM journey, below a maturity model for AM. There are eight categories, each with descriptions of increasing levels of maturity. To start, baseline your company in the eight categories and then, once positioned, look to the higher levels of maturity for suggestions on how to move forward.

For a more refined calibration, a formal on-site assessment is available as well as a facilitated process to create and deploy an AM build-out plan. For information on on-site assessment and AM deployment, send me a note at mike@shipulski.com.

Execution

- Specify AM machine – There a many types of AM machines. Learn to choose the right machine.

- Justify AM machine – Define the problem to be solved and the benefit of solving it.

- Budget for AM machine – Find a budget and create a line item.

- Pay for machine – Choose the supplier and payment method – buy it, rent to own, credit card.

- Install machine – Choose location, provide necessary inputs and connectivity

- Create shapes/add material – Choose the right CAD system for the job, make the parts.

- Create support/service systems – Administer the job queue, change the consumables, maintenance.

- Security – Create a system for CAD files and part files to move securely throughout the organization.

- Standardize – Once the first machines are installed, converge on a small set of standard machines.

- Teach/Train – Create training material for running AM machine and creating shapes.

Solution

- Copy/Replace – Download a shape from the web and make a copy or replace a broken part.

- Adapt/Improve – Add a new feature or function, change color, improve performance.

- Create/Learn – Create something new, show your team, show your customers.

- Sell Products/Services – Sell high volume AM-produced products for a profit. (Stretch goal.)

Volume

- Make one part – Make one part and be done with it.

- Make five parts – Make a small number of parts and learn support material is a challenge.

- Make fifty parts – Make more than a handful of parts. Filament runs out, machines clog and jam.

- Make parts with a complete manufacturing system – This topic deserves a post all its own.

Complexity

- Make a single piece – Make one part.

- Make a multi-part assembly – Make multiple parts and fasten them together.

- Make a building block assembly – Make blocks that join to form an assembly larger than the build area.

- Consolidate – Redesign an assembly to consolidate multiple parts into fewer.

- Simplify – Redesign the consolidated assembly to eliminate features and simplify it.

Material

- Plastic – Low temperature plastic, multicolor plastics, high performance plastics.

- Metal – Low melting temperature with low conductivity, higher melting temps, higher conductivity

- Ceramics – common materials with standard binders, crazy materials with crazy binders.

- Hybrid – multiple types of plastics in a single part, multiple metals in one part, custom metal alloy.

- Incompatible materials – Think oil and water.

Scale

- 50 mm – Not too large and not too small. Fits the build area of medium-sized machine.

- 500 mm – Larger than the build area of medium-sized machine.

- 5 m – Requires a large machine or joining multiple parts in a building block way.

- 0.5 mm – Tiny parts, tiny machines, superior motion control and material control.

Organizational Breadth

- Individuals – Early adopters operate in isolation.

- Teams – Teams of early adopters gang together and spread the word.

- Functions – Functional groups band together to advance their trade.

- Supply Chain – Suppliers and customers work together to solve joint problems.

- Business Units – Whole business units spread AM throughout the body of their work.

- Company – Whole company adopts AM and deploys it broadly.

Strategic Importance

- Novelty – Early adopters think it’s cool and learn what AM can do.

- Point Solution – AM solves an important problem.

- Speed – AM speeds up the work.

- Profitability – AM improves profitability.

- Initiative – AM becomes an initiative and benefits are broadly multiplied.

- Competitive Advantage – AM generates growth and delivers on Vital Business Objectives (VBOs).

Image credit – Cheryl

Quantification of Novel, Useful and Successful

Argument is unskillful but analysis is skillful. And what’s needed for analysis is a framework and some good old-fashioned quantification. To create the supporting conditions for an analysis around novelty, usefulness, and successfulness, I’ve created quantifiable indices and a process to measure them. The process starts with a prototype of a new product, service or business model which is shown to potential customers (real people who do work in the space of interest.)

The Novelty Index. The Novelty Index measures the difference of a product, service or business model from the state-of-the-art. Travel to the potential customer and hand them the prototype. With mouth closed and eyes open, watch them use the product or interact with the service. Measure the time it takes them to recognize the novelty of the prototype and assign a value from 0 to 5. (Higher is better.)

5 – Novelty is recognized immediately after a single use (within 5 seconds.)

4 – Novelty is recognized after several uses (30 seconds.)

3 – Novelty is recognized once a pattern emerges (10-30 minutes.)

2 – Novelty is recognized the next day, once the custom has time to sleep on it (24 hours.)

1 – A formalized A-B test with statistical analysis is needed (1 week.)

0 – The customer says there’s no difference. Stop the project and try something else.

The Usefulness Index. The Usefulness Index measures the level of importance of the novelty. Once the customer recognizes the novelty, take the prototype away from them and evaluate their level of anger.

5 – The customer is irate and seething. They rip it from your arms and demand to place an order for 50 units.

4 – The customer is deeply angry and screams at you to give it back. Then they tell you they want to buy the prototype.

3 – With a smile of happiness, the customer asks to try the prototype again.

2 – The customer asks a polite question about the prototype to make you feel a bit better about their lack of interest.

1 – The customer is indifferent and says it’s time to get some lunch.

0 – Before you ask, the customer hands it back to you before you and is happy not to have it. Stop the project and try something else.

The Successfulness Index. The Successfulness Index measures the incremental profitability the novel product, service or business model will deliver to your company’s bottom line. After taking the prototype from the customer and measuring the Usefulness Index, with your prototype in hand, ask the customer how much they’d pay for the prototype in its current state.

5 – They’d pay 10 times your estimated cost.

4 – They’d pay two times your estimated cost.

3 – They’d pay 30% more than your estimated cost.

2 – They’d pay 10% more than your estimated cost.

1 – They’d pay you 5% more than your estimated cost.

0 – They don’t answer because they would never buy it.

The Commercialization Index. The Commercialization Index describes the overall significance of the novel product, service or business model and it’s calculated by multiplying the three indicies. The maximum value is 125 (5 x 5 x 5) and the minimum value is 0. Again, higher is better.

The descriptions of the various levels are only examples, and you can change them any way you want. And you can change the value ranges as you see fit. (0-5 is just one way to do it.) And you can substitute actual prototypes with sketches, storyboards or other surrogates.

Modify it as you wish, and make it your own. I hope you find it helpful.

Image credit – Nisarg Lakhmani

Is the new one better than the old one?

Successful commercialization of products and services is fueled by one fundamental – making the new one better than the old one. If the new one is better the customer experience is better, the marketing is better, the sales are better and the profits are better.

Successful commercialization of products and services is fueled by one fundamental – making the new one better than the old one. If the new one is better the customer experience is better, the marketing is better, the sales are better and the profits are better.

It’s not enough to know in your heart that the new one is better, there’s got to be objective evidence that demonstrates the improvement. The only way to do that is with testing. There are a number of types testing mechanisms, but whether it’s surveys, interviews or in-the-lab experiments, test results must be quantifiable and repeatable.

The best way I know to determine if the new one is better than the old one is to test both populations with the same test protocol done on the same test setup and measure the results (in a quantified way) using the same measurement system. Sounds easy, but it’s not. The biggest mistake is the confusion between the “same” test conditions and “almost the same” test conditions. If the test protocol is slightly different there’s no way to tell if the difference between new and old is due to goodness of the new design or the badness of the test setup. This type of uncertainty won’t cut it.

You can never be 100% sure that new one is better than the old one, but that’s were statistics come in handy. Without getting deep into the statistics, here’s how it goes. For both population’s test results the mean and standard deviation (spread) are calculated, and taking into consideration the sample size of the test results, the statistical test will tell you if they’re different and confidence of it’s discernment.

The statistical calculations (Student’s t-test) aren’t all that important, what’s important is to understand the implications of the calculations. When there’s a small difference between new and old, the sample size must be large for the statistics to recognize a difference. When the difference between populations is huge, a sample size of one will do nicely. When the spread of the data within a population is large, the statistics need a large sample size or it can’t tell new from old. But when the data is tight, they can see more clearly and need fewer samples to see a difference.

If marketing claims are based on large sample sizes, the difference between new and old is small. (No one uses large sample sizes unless they have to because they’re expensive.) But if in a design review for the new product the sample size is three and the statistical confidence is 95%, new is far better than old. If the average of new is much larger than the average of old and the sample size is large yet the confidence is low, the statistics know the there’s a lot of variability within the populations. (A visual check should show the distributions to more wide than tall.)

The measurement systems used in the experiments can give a good indication of the difference between new and old. If the measurement system is expensive and complicated, likely the difference between new and old is small. Like with large sample sizes, the only time to use an expensive measurement system is when it is needed. And when the difference between new and old is small, the expensive measurement system’s ability accurately and repeatably measure small differences (micrometers vs. meters).

If you need large sample sizes, expensive measurement systems and complicated statistical analyses, the new one isn’t all that different from the old one. And when that’s the case, your new profits will be much like your old ones. But if your naked eye can see the difference with a back-to-back comparison using a sample size of one, you’re on to something.

Image credit – amanda tipton

If you don’t know the critical path, you don’t know very much.

Once you have a project to work on, it’s always a challenge to choose the first task. And once finished with the first task, the next hardest thing is to figure out the next next task.

Once you have a project to work on, it’s always a challenge to choose the first task. And once finished with the first task, the next hardest thing is to figure out the next next task.

Two words to live by: Critical Path.

By definition, the next task to work on is the next task on the critical path. How do you tell if the task is on the critical path? When you are late by one day on a critical path task, the project, as a whole, will finish a day late. If you are late by one day and the project won’t be delayed, the task is not on the critical path and you shouldn’t work on it.

Rule 1: If you can’t work the critical path, don’t work on anything.

Working on a non-critical path task is worse than working on nothing. Working on a non-critical path task is like waiting with perspiration. It’s worse than activity without progress. Resources are consumed on unnecessary tasks and the resulting work creates extra constraints on future work, all in the name of leveraging the work you shouldn’t have done in the first place.

How to spot the critical path? If a similar project has been done before, ask the project manager what the critical path was for that project. Then listen, because that’s the critical path. If your project is similar to a previous project except with some incremental newness, the newness is on the critical path.

Rule 2: Newness, by definition, is on the critical path.

But as the level of newness increases, it’s more difficult for project managers to tell the critical path from work that should wait. If you’re the right project manager, even for projects with significant newness, you are able to feel the critical path in your chest. When you’re the right project manager, you can walk through the cubicles and your body is drawn to the critical path like a divining rod. When you’re the right project manager and someone in another building is late on their critical path task, you somehow unknowingly end up getting a haircut at the same time and offering them the resources they need to get back on track. When you’re the right project manager, the universe notifies you when the critical path has gone critical.

Rule 3: The only way to be the right project manager is to run a lot of projects and read a lot. (I prefer historical fiction and biographies.)

Not all newness is created equal. If the project won’t launch unless the newness is wrestled to the ground, that’s level 5 newness. Stop everything, clear the decks, and get after it until it succumbs to your diligence. If the product won’t sell without the newness, that’s level 5 and you should behave accordingly. If the newness causes the product to cost a bit more than expected, but the project will still sell like nobody’s business, that’s level 2. Launch it and cost reduce it later. If no one will notice if the newness doesn’t make it into the product, that’s level 0 newness. (Actually, it’s not newness at all, it’s unneeded complexity.) Don’t put in the product and don’t bother telling anyone.

Rule 4: The newness you’re afraid of isn’t the newness you should be afraid of.

A good project plan starts with a good understanding of the newness. Then, the right project work is defined to make sure the newness gets the attention it deserves. The problem isn’t the newness you know, the problem is the unknown consequence of newness as it ripples through the commercialization engine. New product functionality gets engineering attention until it’s run to ground. But what if the newness ripples into new materials that can’t be made or new assembly methods that don’t exist? What if the new materials are banned substances? What if your multi-million dollar test stations don’t have the capability to accommodate the new functionality? What if the value proposition is new and your sales team doesn’t know how to sell it? What if the newness requires a new distribution channel you don’t have? What if your service organization doesn’t have the ability to diagnose a failure of the new newness?

Rule 5: The only way to develop the capability to handle newness is to pair a soon-to-be great project manager with an already great project manager.

It may sound like an inefficient way to solve the problem, but pairing the two project managers is a lot more efficient than letting a soon-to-be great project manager crash and burn. After an inexperienced project manager runs a project into the ground, what’s the first thing you do? You bring in a great project manager to get the project back on track and keep them in the saddle until the product launches. Why not assume the wheels will fall off unless you put a pro alongside the high potential talent?

Rule 6: When your best project managers tell you they need resources, give them what they ask for.

If you want to deliver new value to new customs there’s no better way than to develop good project managers. A good project manager instinctively knows the critical path; they know how the work is done; they know to unwind situations that needs to be unwound; they have the personal relationships to get things done when no one else can; because they are trusted, they can get people to bend (and sometimes break) the rules and feel good doing it; and they know what they need to successfully launch the product.

If you don’t know your critical path, you don’t know very much. And if your project managers don’t know the critical path, you should stop what you’re doing, pull hard on the emergency break with both hands and don’t release it until you know they know.

Image credit – Patrick Emerson

Patents are supposed to improve profitability.

Everyone likes patents, but few use them as a business tool.

Everyone likes patents, but few use them as a business tool.

Patents define rights assigned by governments to inventors (really, the companies they work for) where the assignee has the right to exclude others from practicing the concepts described in the patent claims. And patent rights are limited to the countries that grant patents. If you want to get patent rights in a country, you submit your request (application) and run their gauntlet. Patents are a country-by-country business.

Patents are expensive. Small companies struggle to justify the expense of filing a single patent and big companies struggle to justify the expense of their portfolio. All companies want to reduce patent costs.

The patent process starts with invention. Someone must go to the lab and invent something. The invention is documented by the inventor (invention disclosure) and the invention is scored by a cross-functional team to decide if it’s worthy of filing. If deemed worthy, a clearance search is done to see if it’s different from all other patents, all products offered for sale, and all the other literature in the public domain (research papers, publications). Then, then the patent attorneys work their expensive magic to draft a patent application and file it with the government of choice. And when the rejection arrives, the attorneys do some research, address the examiner’s concerns and submit the paperwork.

Once granted, the fun begins. The company must keep watch on the marketplace to make sure no one sells products that use the patented technology. It’s a costly, never-ending battle. If infringement is suspected, the attorneys exchange documents in a cease-and-desist jousting match. If there’s no resolution, it’s time to go to court where prosecution work turns up the burn rate to eleven.

To reduce costs, companies try to reduce the price they pay to outside law firms that draft their patents. It’s a race to the bottom where no one wins. Outside firms get paid less money per patent and the client gets patents that aren’t as good as they could be. It’s a best practice, but it’s not best. Treating patent work as a cost center isn’t right. Patents are a business tool that help companies make money.

Companies are in business to make money and they do that by selling products for more than the cost to make them. They set clear business objectives for growth and define the market-customers to fuel that growth. And the growth is powered by the magic engine of innovation. Innovation creates products/services that are novel, useful and successful and patents protect them. That’s what patents do best and that’s how companies should use them.

If you don’t have a lot of time and you want to understand a patent, read the claims. If you have less time, read the independent claims. Chris Brown, Ph.D.

Patents are all about claims. The claims define how the invention is different (novel) from what’s tin the public domain (prior art). And since innovation starts with different, patents fit nicely within the innovation framework. Instead of trying to reduce patent costs, companies should focus on better claims, because better claims means better patents. Here are some thoughts on what makes for good claims.

Patent claims should capture the novelty of the invention, but sometimes the words are wrong and the claims don’t cover the invention. And when that happens, the patent issues but it does not protect the invention – all the downside with none of the upside. The best way to make sure the claims cover the invention is for the inventor to review the claims before the patent is filed. This makes for a nice closed-loop process.

When a novel technology has the potential to provide useful benefit to a customer, engineers turn those technologies into prototypes and test them in the lab. Since engineers are minimum energy creatures and make prototypes for only the technologies that matter, if the patent claims cover the prototype, those are good claims.

When the prototype is developed into a product that is sold in the market and the novel technology covered by the claims is what makes the product successful, those are good claims.

If you were to remove the patented technology from the product and your customer would notice it instantly and become incensed, those are the best claims.

Instead of reducing the cost of patents, create processes to make sure the right claims are created. Instead of cutting corners, embed your patent attorneys in the technology development process to file patents on the most important, most viable technology. Instead of handing off invention disclosures to an isolated patent team, get them involved in the corporate planning process so they understand the business objectives and operating plans. Get your patent attorneys out in the field and let them talk to customers. That way they’ll know how to spot customer value and write good claims around it.

Patents are an important business tool and should be used that way. Patents should help your company make money. But patents aren’t the right solution to all problems. Patent work can be slow, expensive and uncertain. A more powerful and more certain approach is a strong investment in understanding the market, ritualistic technology development, solid commercialization and a relentless pursuit of speed. And the icing on the top – a slathering of good patent claims to protect the most important bits.

Image credit – Matthais Weinberger

Hands-On or Hands-Off?

Hands-on versus hands-off – as a leader it’s a fundamental choice. And for me the single most important guiding principle is – do what it takes to maintain or strengthen the team’s personal ownership of the work.

Hands-on versus hands-off – as a leader it’s a fundamental choice. And for me the single most important guiding principle is – do what it takes to maintain or strengthen the team’s personal ownership of the work.

If things are going well, keep your hands off. This reinforces the team’s ownership and your trust in them. But it’s not hands-off in and ignore them sense; it’s hands-off in a don’t tell them what to do sense. Walk around, touch base and check in to show interest in the work and avoid interrogation-based methods that undermine your confidence in them. This is not to say a hands-off leader only superficially knows what’s going on, it should only look like the leader has a superficial understanding.

The hands-off approach requires a deep understanding of the work and the people doing it. The hands-off leader must make the time to know the GPS coordinates of the project and then do reconnaissance work to identify the positions of the quagmires and quicksand that lay ahead. The hands-off leader waits patiently just in front of the obstacles and makes no course correction if the team can successfully navigate the gauntlet. But when the team is about to sink to their waists, leader gently nudges so they skirt the dangerous territory.

Unless, of course, the team needs some learning. And in that case, the leader lets the team march it’s project into the mud. If they need just a bit of learning the leader lets them get a little muddy; and if the team needs deep learning, the leader lets them sink to their necks. Either way, the leader is waiting under cover as they approach the impending snafu and is right beside them to pull them out. But to the team, the hands-off leader is not out in front scouting the new territory. To them, the hands-off leader doesn’t pay all that much attention. To the team, it’s just a coincidence the leader happens to attend the project meeting at a pivotal time and they don’t even recognize when the leader subtly plants the idea that lets the team pull themselves out of the mud.

If after three or four near-drowning incidents the team does not learn or change it’s behavior, it’s time for the hands-off approach to look and feel more hands-on. The leader calls a special meeting where the team presents the status of the project and grounds the project in the now. Then, with everyone on the same page the leader facilitates a process where the next bit of work is defined in excruciating detail. What is the next learning objective? What is the test plan? What will be measured? How will it be measured? How will the data be presented? If the tests go as planned, what will you know? What won’t you know? How will you use the knowledge to inform the next experiments? When will we get together to review the test results and your go-forward recommendations?

By intent, this tightening down does not go unnoticed. The next bit of work is well defined and everyone is clear how and when the work will be completed and when the team will report back with the results. The leader reverts back to hands-off until the band gets back together to review the results where it’s back to hands-on. It’s the leader’s judgement on how many rounds of hands-on roulette the team needs, but the fun continues until the team’s behavior changes or the project ends in success.

For me, leadership is always hands-on, but it’s hands-on that looks like hands-off. This way the team gets the right guidance and maintains ownership. And as long as things are going well this is a good way to go. But sometimes the team needs to know you are right there in the trenches with them, and then it’s time for hands-on to look like hands-on. Either way, its vital the team knows they own the project.

There are no schools that teach this. The only way to learn is to jump in with both feet and take an active role in the most important projects.

Image credit – Kerri Lee Smith

To make the right decision, use the right data.

When it’s time for a tough decision, it’s time to use data. The idea is the data removes biases and opinions so the decision is grounded in the fundamentals. But using the right data the right way takes a lot of disciple and care.

When it’s time for a tough decision, it’s time to use data. The idea is the data removes biases and opinions so the decision is grounded in the fundamentals. But using the right data the right way takes a lot of disciple and care.

The most straightforward decision is a decision between two things – an either or – and here’s how it goes.

The first step is to agree on the test protocols and measure systems used to create the data. To eliminate biases, this is done before any testing. The test protocols are the actual procedural steps to run the tests and are revision controlled documents. The measurement systems are also fully defined. This includes the make and model of the machine/hardware, full definition of the fixtures and supporting equipment, and a measurement protocol (the steps to do the measurements).

The next step is to create the charts and graphs used to present the data. (Again, this is done before any testing.) The simplest and best is the bar chart – with one bar for A and one bar for B. But for all formats, the axes are labeled (including units), the test protocol is referenced (with its document number and revision letter), and the title is created. The title defines the type of test, important shared elements of the tested configurations and important input conditions. The title helps make sure the tested configurations are the same in the ways they should be. And to be doubly sure they’re the same, once the graph is populated with the actual test data, a small image of the tested configurations can be added next to each bar.

The configurations under test change over time, and it’s important to maintain linkage between the test data and the tested configuration. This can be accomplished with descriptive titles and formal revision numbers of the test configurations. When you choose design concept A over concept B but unknowingly use data from the wrong revisions it’s still a data-driven decision, it’s just wrong one.

But the most important problem to guard against is a mismatch between the tested configuration and the configuration used to create the cost estimate. To increase profit, test results want to increase and costs wants to decrease, and this natural pressure can create divergence between the tested and costed configurations. Test results predict how the configuration under test will perform in the field. The cost estimate predicts how much the costed configuration will cost. Though there’s strong desire to have the performance of one configuration and the cost of another, things don’t work that way. When you launch you’ll get the performance of AND cost of the configuration you launched. You might as well choose the configuration to launch using performance data and cost as a matched pair.

All this detail may feel like overkill, but it’s not because the consequences of getting it wrong can decimate profitability. Here’s why:

Profit = (price – cost) x volume.

Test results predict goodness, and goodness defines what the customer will pay (price) and how many they’ll buy (volume). And cost is cost. And when it comes to profit, if you make the right decision with the wrong data, the wheels fall off.

Image credit – alabaster crow photographic

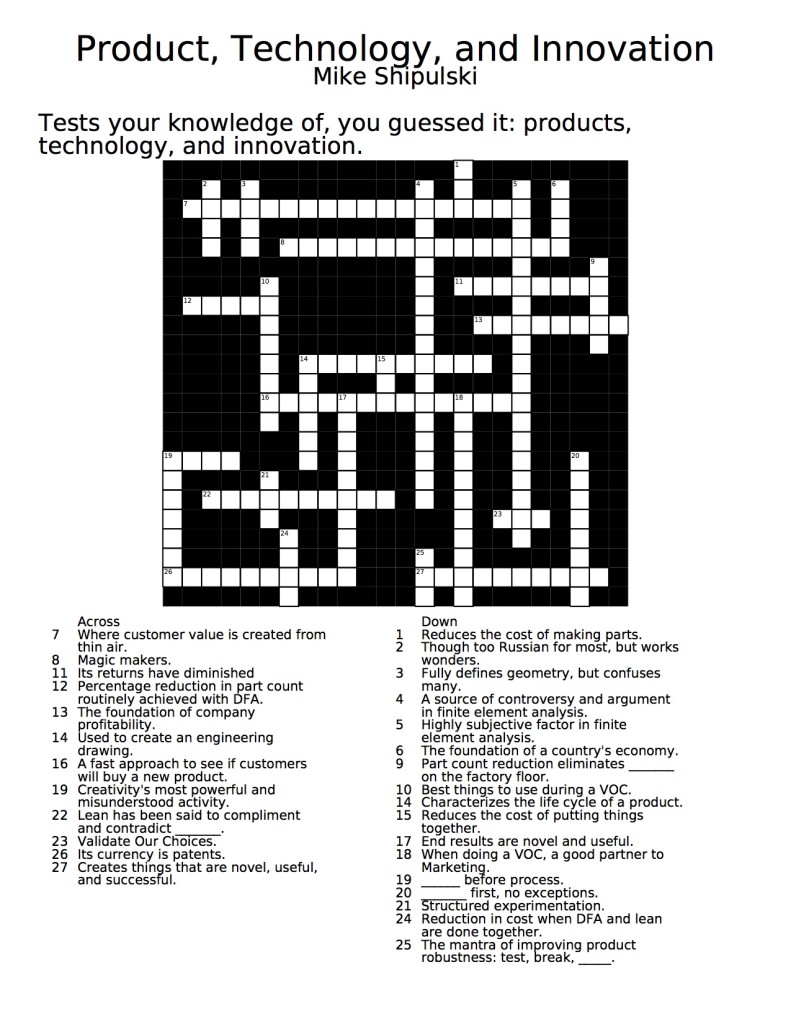

Crossword Puzzle – Product, Technology, Innovation

Here’s something a little different – a crossword puzzle to test your knowledge on products, technology, and innovation. Complete the puzzle using the image below, or download it (and answer key) using the green arrows below, and take your time with it over the Thanksgiving holiday.

[wpdm_file id=5]

[wpdm_file id=4]

The Threshold Of Uncertainty

Our threshold for uncertainty is too low.

Our threshold for uncertainty is too low.

Early in projects, even before the first prototype is up and running, you know what the product must do, what it will cost, and, most problematic, when you’ll be done. Independent of work content, level of newness, and workloads, there’s no uncertainty in your launch date. It’s etched in stone and the consequences are devastating.

A zero tolerance policy on uncertainty forces irrational behavior. As soon as possible, engineering gets something running in the lab, and then doesn’t want to change it because there’s no time. The prototype is almost impossible to build and is hypersensitive to normal process variation, but these issues are not addressed because there’s no time. Everyone agrees it’s important to fix it, and agrees to fix it after launch, but that never happens because the next project is already late before it starts. And the death cycle repeats project after project.

The root cause of this mess is the mistaken porting of manufacturing’s zero uncertainly mindset into design. The thinking goes like this – lean and Six Sigma have achieved magical success in manufacturing by eliminating uncertainty, so let’s do it in product design and achieve similar results. This is a fundamental mistake as the domains are fundamentally different.

In manufacturing the same product is made day-in and day-out – no uncertainty; in product design no two product development efforts are the same and there’s lots of stuff that’s done for the first time – uncertainty by definition. In manufacturing there’s a revision controlled engineering drawing that defines the right answer (the geometry and the material) – make it like the picture and it’s all good; in product design the material is chosen from many candidates and the geometry is created from scratch – the picture is created from nothing. By definition there’s more inherent uncertainty in product design, and to tighten the screws and fix the launch date at the start is inappropriate.

Design engineers must feel like there’s enough time to try new things because new products that provide new functionality require new technologies, new materials, and new geometries. With new comes inherent uncertainty, but there are ways to manage it.

To hold the timeline, give on the specification and cost. Design as fast as you can until you run out of time then launch. The product won’t work as well as you’d like and it will cost more than you’d like, but you’ll hit the schedule. A good way to do this is to de-feature a subassembly to reduce design time, and possibly reduce cost. Or, reuse a proven subassembly to reduce design time – take a hit in cost, but hit the timeline. The general idea – hold schedule but flex on performance and cost.

It feels like sacrilege to admit that something’s got to give, but it’s the truth. You’ve seen how it goes when you edict (in no uncertain terms) that the timeline will be met and there’ll be no give on performance and cost. It hasn’t worked, and it won’t – the inherent uncertainty of product design won’t let it.

Accept the uncertainty; be one with it; and manage it. It’s the only way.

Mike Shipulski

Mike Shipulski