Archive for the ‘Manufacturing Competitiveness’ Category

Resurrecting Manufacturing Through Product Simplification

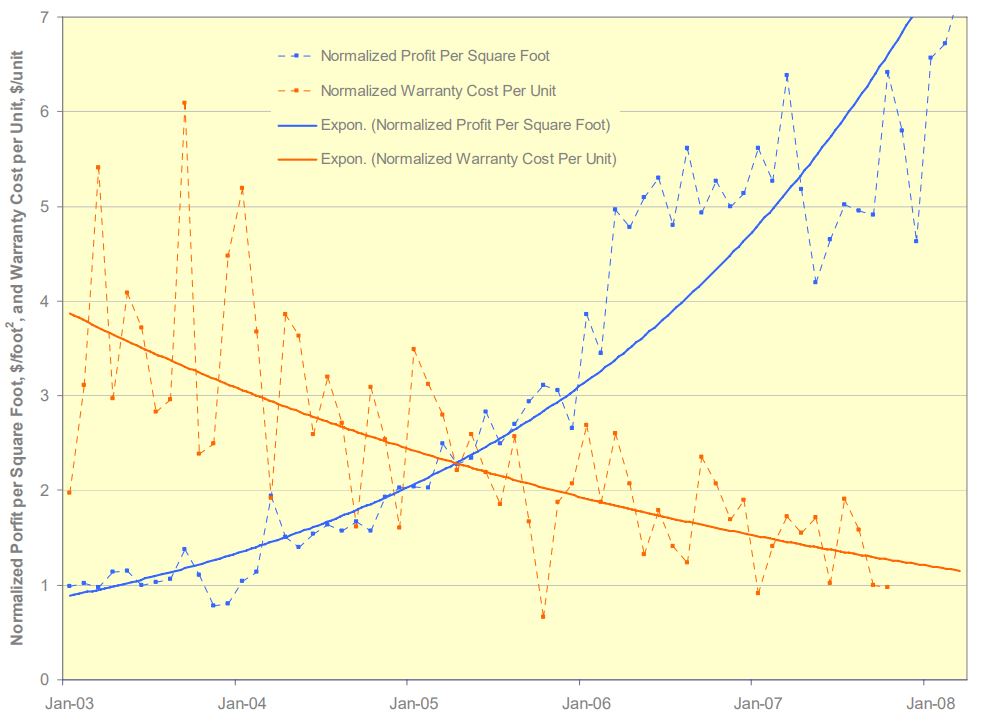

Product simplification can radically improve profits and radically improve product robustness. Here’s a graph of profit per square foot ($/ft^2) which improved by a factor of seven and warranty cost per unit ($/unit), a measure of product robustness), which improved by a factor of four. The improvements are measured against the baseline data of the legacy product which was replaced by the simplified product. Design for Assembly (DFA) was used to simplify the product and Robust Design methods were used to reduce warranty cost per unit.

I will go on record that everyone will notice when profit per square foot increases by a factor of seven.

And I will also go on record that no one will believe you when you predict product simplification will radically improve profit per square foot.

And I will go on record that when warranty cost per unit is radically reduced, customers will notice. Simply put, the product doesn’t break and your customers love it.

But here’s the rub. The graph shows data over five years, which is a long time. And if the product development takes two years, that makes seven long years. And in today’s world, seven years is at least four too many. But take another look at the graph. Profit per square foot doubled in the first two years after launch. Two years isn’t too long to double profit per square foot. I don’t know of a faster way, More strongly, I don’t know of another way to get it done, regardless of the timeline.

I think your company would love to double the profit per square foot of its assembly area. And I’ve shown you the data that proves it’s possible. So, what’s in the way of giving it a try?

For the details about the work, here’s a link – Systematic DFMA Deployment, It Could Resurrect US Manufacturing.

How flexible are your processes and how do you know?

What would happen if the factory had to support demand that increased one percent per week? Without incremental investment, how many weeks could they meet the ever-increasing demand? That number is a measure of the system’s flexibility. More weeks, more flexibility. And the element of the manufacturing system that gives out first is the constraint. So, now you know how much demand you can support before there’s a problem and you know what the problem will be. And if you know the lead time to implement the improvement needed to support the increased demand, in a reverse-scheduling way, you know when to implement the improvement so it comes online when you need it.

What would happen if the factory had to support demand that increased one percent per week? Without incremental investment, how many weeks could they meet the ever-increasing demand? That number is a measure of the system’s flexibility. More weeks, more flexibility. And the element of the manufacturing system that gives out first is the constraint. So, now you know how much demand you can support before there’s a problem and you know what the problem will be. And if you know the lead time to implement the improvement needed to support the increased demand, in a reverse-scheduling way, you know when to implement the improvement so it comes online when you need it.

What would happen if the factory had to support demand that increased one percent in a week? How about two percent in a week, five percent, or ten percent? Without incremental investment, what percentage increase could they support in a single week? More percent increase, more flexibility. And the element of the manufacturing system that gives out first is the constraint. So, now you know how much increased demand you can support in a single week and you know the gating item that will block further increases. You know now where to clip the increased demand and push the extra demand into the next week. And you know the investment it would take to support a larger increase in a single week.

These two scenarios can be used to assess and quantify a process of any type. For example, to understand the flexibility of the new product development process, load it (virtually) with more projects to see where it breaks. Make a note of what it would take to increase the system’s flexibility and ask yourself if that’s a good investment. If it is, make that investment. If it isn’t, don’t.

This simple testing method is especially useful when the investment needed to increase flexibility has a long lead time or is expensive. If your testing says the system can support five percent more demand before it breaks and you know that demand will hit the system in ten weeks, I hope the lead time to implement the needed improvement is less than ten weeks. If not, you won’t be able to meet the increased demand. And I hope the money to make the improvement is already budgeted because a budgeting cycle is certainly longer than ten weeks and you can’t buy what you need if the money isn’t in the budget.

The first question to ask yourself is what is the minimum flexibility of the system that will trigger the next investment to improve throughput and increase flexibility? And the follow-on question: What is needed to improve throughput? What is the lead time for that solution? How much will it cost? Is the money budgeted? And do we have the resources (people) that can implement the improvement when it’s time?

When the cost of not meeting demand is high, the value of this testing process is high. When the lead times for the improvements are long, this testing process has a lot of value because it gives you time to put the improvements in place.

Continuous improvement of process utilization is also a continuous reduction of process flexibility. This simple testing approach can help identify when process flexibility is becoming dangerously low and give you the much-needed time to put improvements in place before it’s too late.

Image credit — Tambako The Jaguar

You are defined by the problems you solve.

You can solve problems that reduce the material costs of your products.

You can solve problems that reduce the material costs of your products.

You can solve problems that reduce the number of people that work at your company.

You can solve problems that save your company money.

You can solve problems that help your customers make progress.

You can solve problems that make it easier for your customers to buy from you.

You can solve too many small problems and too few big problems.

You can solve problems that ripple profits through your whole organization.

You can solve local problems.

You can solve problems that obsolete your best products.

You can solve problems that extend and defend your existing products.

You can solve problems that spawn new businesses.

You can solve the wrong problems.

You can solve problems before their time or after it is too late.

You can solve problems that change your company or block it from change.

You are defined by the problems you solve. So, which type of problems do you solve and how do you feel about that?

Image credit – Maureen Barlin

Radical Cost Reduction and Reinvented Supply Chains

As geopolitical pressures rise, some countries that supply the parts that make up your products may become nonviable. What if there was a way to reinvent the supply chain and move it to more stable regions? And what if there was a way to guard against the use of child labor in the parts that make up your product? And what if there was a way to shorten your supply chain so it could respond faster? And what if there was a way to eliminate environmentally irresponsible materials from your supply chain?

As geopolitical pressures rise, some countries that supply the parts that make up your products may become nonviable. What if there was a way to reinvent the supply chain and move it to more stable regions? And what if there was a way to guard against the use of child labor in the parts that make up your product? And what if there was a way to shorten your supply chain so it could respond faster? And what if there was a way to eliminate environmentally irresponsible materials from your supply chain?

Our supply chains source parts from countries that are less than stable because the cost of the parts made in those countries is low. And child labor can creep into our supply chains because the cost of the parts made with child labor is low. And our supply chains are long because the countries that make parts with the lowest costs are far away. And our supply chains use environmentally irresponsible materials because those materials reduce the cost of the parts.

The thing with the supply chains is that the parts themselves govern the manufacturing processes and materials that can be used, they dictate the factories that can be used and they define the cost. Moving the same old parts to other regions of the world will do little more than increase the price of the parts. If we want to radically reduce cost and reinvent the supply chain, we’ve got to reinvent the parts.

There are methods that can achieve radical cost reduction and reinvent the supply chain, but they are little known. The heart of one such method is a functional model that fully describes all functional elements of the system and how they interact. After the model is complete, there is a straightforward, understandable, agreed-upon definition of how the product functions which the team uses to focus the go-forward design work. And to help them further, the method provides guidelines and suggestions to prioritize the work.

I think radical cost reduction and more robust supply chains are essential to a company’s future. And I am confident in the ability of the methods to deliver solid results. But what I don’t know is: Is the need for radical cost reduction strong enough to cause companies to adopt these methods?

“Zen” by g0upil is licensed under CC BY-SA 2.0.

Three Scenarios for Scaling Up the Work

Breaking up work into small chunks can be a good way to get things started. Because the scope of each chunk is small, the cost of each chunk is small making it easier to get approval to do the work. The chunk approach also reduces anxiety around the work because if nothing comes from the chunk, it’s not a big deal because the cost of the work is so low. It’s a good way to get started, and it’s a good way to do a series of small chunks that build on each other. But what happens when the chunks are successful and it’s time to scale up the investment by a factor of several hundred thousand or a million?

Breaking up work into small chunks can be a good way to get things started. Because the scope of each chunk is small, the cost of each chunk is small making it easier to get approval to do the work. The chunk approach also reduces anxiety around the work because if nothing comes from the chunk, it’s not a big deal because the cost of the work is so low. It’s a good way to get started, and it’s a good way to do a series of small chunks that build on each other. But what happens when the chunks are successful and it’s time to scale up the investment by a factor of several hundred thousand or a million?

The scaling scenario. When the early work (the chunks) was defined an agreement in principle was created that said the larger investment would be made in a timely way if the small chunks demonstrated the viability of a whole new offering for your customers. The result of this scenario is a large investment is allocated quickly, resources flow quickly, and the scaling work begins soon after the last chunk is finished. This is the least likely scenario.

The more chunks scenario. When the chunks were defined, everyone was excited that the novel work had actually started and there was no real thought about the resources required to scale it into something meaningful and material. Since the resources needed to scale were not budgeted, the only option to keep things going is to break up the work into another series of small chunks. Though the organization sees this as progress, it’s not. The only thing that can deliver the payout the organization needs is to scale up the work. The follow-on chunks distract the company and let it think there is progress, when, really, there is only delayed scaling.

The scale next year scenario. When the chunks were defined, no one thought about scaling so there was no money in the budget to scale. A plan and cost estimate are created for the scaling work and the package waits to be assessed as part of the annual planning process. And as the waiting happens, the people that did the early work (the chunks) move on to other projects and are not available to do the scaling work even if the work gets funded next year. And because the work is new it requires new infrastructure, new resources, new teams, new thinking, and maybe a new company. All this newness makes the price tag significant and it may require more than one annual planning cycle to justify the expense and start the work.

Scaling a new invention into a full-sized business is difficult and expensive, but if you’re looking to create radical growth, scaling is the easiest and least expensive way to go.

“100 Dollar Bills” by Philip Taylor PT is licensed under CC BY-SA 2.0.

The best time to design cost out of our products is now.

With inflation on the rise and sales on the decline, the time to reduce costs is now.

With inflation on the rise and sales on the decline, the time to reduce costs is now.

But before you can design out the cost you’ve got to know where it is. And the best way to do that is to create a Pareto chart that defines product cost for each subassembly, with the highest cost subassemblies on the left and the lowest cost on the right. Here’s a pro tip – Ignore the subassemblies on the right.

Use your costed Bill of Materials (BOMs) to create the Paretos. You’ll be told that the BOMs are wrong (and they are), but they are right enough to learn where the cost is.

For each of the highest-cost subassemblies, create a lower-level Pareto chat that sorts the cost of each piece-part from highest to lowest. The pro tip applies here, too – Ignore the parts on the right.

Because the design community designed in the cost, they are the ones who must design it out. And to help them prioritize the work, they should be the ones who create the Pareto charts from the BOMs. They won’t like this idea, but tell them they are the only ones who can secure the company’s future profits and buy them lots of pizza.

And when someone demands you reduce labor costs, don’t fall for it. Labor cost is about 5% of the product cost, so reducing it by half doesn’t get you much. Instead, make a Pareto chart of part count by subassembly. Focus the design effort on reducing the part count of subassemblies on the left. Pro tip – Ignore the subassemblies on the right. The labor time to assemble parts that you design out is zero, so when demand returns, you’ll be able to pump out more products without growing the footprint of the factory. But, more importantly, the cost of the parts you design out is also zero. Designing out the parts is the best way to reduce product costs.

Pro tip – Set a cost reduction goal of 35%. And when they complain, increase it to 40%.

In parallel to the design work to reduce part count and costs, design the test fixtures and test protocols you’ll use to make sure the new, lower-cost design outperforms the existing design. Certainly, with fewer parts, the new one will be more reliable. Pro tip – As soon as you can, test the existing design using the new protocols because the only way to know if the new one is better is to measure it against the test results of the old one.

And here’s the last pro tip – Start now.

Image credit — aisletwentytwo

Supply chains don’t have to break.

We’ve heard a lot about long supply chains that have broken down, parts shortages, and long lead times. Granted, supply chains have been stressed, but we’ve designed out any sort of resiliency. Our supply chains are inflexible, our products are intolerant to variation and multiple sources for parts, and our organizations have lost the ability to quickly and effectively redesign the product and the parts to address issues when they arise. We’ve pushed too hard on traditional costing and have not placed any value on flexibility. And we’ve pushed too hard on efficiency and outsourced our design capability so we can no longer design our way out of problems.

We’ve heard a lot about long supply chains that have broken down, parts shortages, and long lead times. Granted, supply chains have been stressed, but we’ve designed out any sort of resiliency. Our supply chains are inflexible, our products are intolerant to variation and multiple sources for parts, and our organizations have lost the ability to quickly and effectively redesign the product and the parts to address issues when they arise. We’ve pushed too hard on traditional costing and have not placed any value on flexibility. And we’ve pushed too hard on efficiency and outsourced our design capability so we can no longer design our way out of problems.

Our supply chains are inflexible because that’s how we designed them. The products cannot handle parts from multiple suppliers because that’s how we designed them. And the parts cannot be made by multiple suppliers because that’s how we designed them.

Now for the upside. If we want a robust supply chain, we can design the product and the parts in a way that makes a robust supply chain possible. If we want the flexibility to use multiple suppliers, we can design the product and parts in a way that makes it possible. And if we want the capability to change the product to adapt to unforeseen changes, we can design our design organizations to make it possible.

There are established tools and methods to help the design community design products in a way that creates flexibility in the supply chain. And those same tools and methods can also help the design community create products that can be made with parts from multiple suppliers. And there are teachers who can help rebuild the design community’s muscles so they can change the product in ways to address unforeseen problems with parts and suppliers.

How much did it cost you when your supply chain dried up? How much did it cost you the last time a supplier couldn’t deliver your parts? How much did it cost you when your design community couldn’t redesign the product to keep the assembly line running? Would you believe me if I told you that all those costs are a result of choices you made about how to design your supply chain, your product, your parts, and your engineering community?

And would you believe me if I told you could make all that go away? Well, even if you don’t believe me, the potential upside of making it go away is so significant you may want to look into it anyway.

Image credit — New Manufacturing Challenge, Suzaki, 1987.

A Recipe to Grow Revenue Now

If you want to grow the top line right now, create a hard constraint – the product cannot change – and force the team to look for growth outside the product. Since all the easy changes to the product have been made, without a breakthrough the small improvements bring diminishing returns. There’s nothing left here. Make them look elsewhere.

If you want to grow the top line right now, create a hard constraint – the product cannot change – and force the team to look for growth outside the product. Since all the easy changes to the product have been made, without a breakthrough the small improvements bring diminishing returns. There’s nothing left here. Make them look elsewhere.

If you want to grow the top line without changing the product, make it easier for customers to buy the products you already have.

If you want to make it easier for customers to buy what you have, eliminate all things that make buying difficult. Though this sounds obvious and trivial, it’s neither. It’s exceptionally difficult to see the waste in your processes from the customers’ perspective. The blackbelts know how to eliminate waste from the company’s perspective, but they’ve not been taught to see waste from the customers’ perspective. Don’t believe me? Look at the last three improvements you made to the customers’ buying process and ask yourself who benefitted from those changes. Odds are, the changes you made reduced the number of people you need to process the transactions by pushing the work back into the customers’ laps. This is the opposite of making it easier for your customers to buy.

Have you ever run a project to make it easier for customers to buy from you?

If you want to make it easier for customers to buy the products you have, pretend you are a customer and map their buying process. What you’ll likely learn is that it’s not easy to buy from you.

How can you make it easier for the customer to choose the right product to buy? Please don’t confuse this with eliminating the knowledgeable people who talk on the phone with customers. And, fight the urge to display all your products all at once. Minimize their choices, don’t maximize them.

How can you make it easier for customers to buy what they bought last time? A hint: when an existing customer hits your website, the first thing they should see is what they bought last time. Or, maybe, a big button that says – click here to buy [whatever they bought last time]. This, of course, assumes you can recognize them and can quickly match them to their buying history.

How can you make it easier for customers to pay for your product? Here’s a rule to live by: if they don’t pay, you don’t sell. And here’s another: you get no partial credit when a customer almost pays.

As you make these improvements, customers will buy more. You can use the incremental profits to fund the breakthrough work to obsolete your best products.

“Shopping Cart” by edenpictures is licensed under CC BY 2.0

Technical Risk, Market Risk, and Emotional Risk

Technical risk – Will it work?

Market risk – Will they buy it?

Emotional risk – Will people laugh at your crazy idea?

Technical risk – Test it in the lab.

Market risk – Test it with the customer.

Emotional risk – Try it with a friend.

Technical risk – Define the right test.

Market risk – Define the right customer.

Emotional risk – Define the right friend.

Technical risk – Define the minimum acceptable performance criteria.

Market risk – Define the minimum acceptable response from the customer.

Emotional risk – Define the minimum acceptable criticism from your friend.

Technical risk – Can you manufacture it?

Market risk – Can you sell it?

Emotional risk – Can you act on your crazy idea?

Technical risk – How sure are you that you can manufacture it?

Market risk – How sure are you that you can sell it?

Emotional risk – How sure are you that you can act on your crazy idea?

Technical risk – When the VP says it can’t be manufactured, what do you do?

Market risk – When the VP says it can’t be sold, what do you do?

Emotional risk – When the VP says your idea is too crazy, what do you do?

Technical risk – When you knew the technical risk was too high, what did you do?

Market risk – When you knew the market risk was too high, what did you do?

Emotional risk – When you knew someone’s emotional risk was going to be too high, what did you do?

Technical risk – Can you teach others to reduce technical risk? How about increasing it?

Market risk – Can you teach others to reduce technical risk? How about increasing it?

Emotional risk – Can you teach others to reduce emotional risk? How about increasing it?

Technical risk – What does it look like when technical risk is too low? And the consequences?

Market risk – What does it look like when technical risk is too low? And the consequences?

Emotional risk – What does it look like when emotional risk is too low? And the consequences?

We are most aware of technical risk and spend most of our time trying to reduce it. We have the mindset and toolset to reduce it. We know how to do it. But we were not taught to recognize when technical risk is too low. And if we do recognize it’s too low, we don’t know how to articulate the negative consequences. With all this said, market risk is far more dangerous.

We’re unfamiliar with the toolset and mindset to reduce market risk. Where we can change the design, run the test, and reduce technical risk, market risk is not like that. It’s difficult to understand what drives the customers’ buying decision and it’s difficult to directly (and quickly) change their buying decision. In short, it’s difficult to know what to change so they make a different buying decision. And if they don’t buy, you don’t sell. And that’s a big problem. With that said, emotional risk is far more debilitating.

When a culture creates high emotional risk, people keep their best ideas to themselves. They don’t want to be laughed at or ridiculed, so their best ideas don’t see the light of day. The result is a collection of wonderful ideas known only to the underground Trust Network. A culture that creates high emotional risk has insufficient technical and market risk because everyone is afraid of the consequences of doing something new and different. The result – the company with high emotional risk follows the same old script and does what it did last time. And this works well, right up until it doesn’t.

Here’s a three-pronged approach that may help.

- Continue to reduce technical risk.

- Learn to reduce market risk early in a project.

- And behave in a way that reduces emotional risk so you’ll have the opportunity to reduce technical and market risk.

Image credit — Shan Sheehan

The Most Important People in Your Company

When the fate of your company rests on a single project, who are the three people you’d tap to drag that pivotal project over the finish line? And to sharpen it further, ask yourself “Who do I want to lead the project that will save the company?” You now have a list of the three most important people in your company. Or, if you answered the second question, you now have the name of the most important person in your company.

When the fate of your company rests on a single project, who are the three people you’d tap to drag that pivotal project over the finish line? And to sharpen it further, ask yourself “Who do I want to lead the project that will save the company?” You now have a list of the three most important people in your company. Or, if you answered the second question, you now have the name of the most important person in your company.

The most important person in your company is the person that drags the most important projects over the finish line. Full stop.

When the project is on the line, the CEO doesn’t matter; the General Manager doesn’t matter; the Business Leader doesn’t matter. The person that matters most is the Project Manager. And the second and third most important people are the two people that the Project Manager relies on.

Don’t believe that? Well, take a bite of this. If the project fails, the product doesn’t sell. And if the product doesn’t sell, the revenue doesn’t come. And if the revenue doesn’t come, it’s game over. Regardless of how hard the CEO pulls, the product doesn’t launch, the revenue doesn’t come, and the company dies. Regardless of how angry the GM gets, without a product launch, there’s no revenue, and it’s lights out. And regardless of the Business Leader’s cajoling, the project doesn’t cross the finish line unless the Project Manager makes it happen.

The CEO can’t launch the product. The GM can’t launch the product. The Business Leader can’t launch the product. Stop for a minute and let that sink in. Now, go back to those three sentences and read them out loud. No, really, read them out loud. I’ll wait.

When the wheels fall off a project, the CEO can’t put them back on. Only a special Project Manager can do that.

There are tools for project management, there are degrees in project management, and there are certifications for project management. But all that is meaningless because project management is alchemy.

Degrees don’t matter. What matters is that you’ve taken over a poorly run project, turned it on its head, and dragged it across the line. What matters is you’ve run a project that was poorly defined, poorly staffed, and poorly funded and brought it home kicking and screaming. What matters is you’ve landed a project successfully when two of three engines were on fire. (Belly landings count.) What matters is that you vehemently dismiss the continuous improvement community on the grounds there can be no best practice for a project that creates something that’s new to the world. What matters is that you can feel the critical path in your chest. What matters is that you’ve sprinted toward the scariest projects and people followed you. And what matters most is they’ll follow you again.

Project Managers have won the hearts and minds of the project team.

The Project manager knows what the team needs and provides it before the team needs it. And when an unplanned need arises, like it always does, the project manager begs, borrows, and steals to secure what the team needs. And when they can’t get what’s needed, they apologize to the team, re-plan the project, reset the completion date, and deliver the bad news to those that don’t want to hear it.

If the General Manager says the project will be done in three months and the Project Manager thinks otherwise, put your money on the Project Manager.

Project Managers aren’t at the top of the org chart, but we punch above our weight. We’ve earned the trust and respect of most everyone. We aren’t liked by everyone, but we’re trusted by all. And we’re not always understood, but everyone knows our intentions are good. And when we ask for help, people drop what they’re doing and pitch in. In fact, they line up to help. They line up because we’ve gone out of our way to help them over the last decade. And they line up to help because we’ve put it on the table.

Whether it’s IoT, Digital Strategy, Industry 4.0, top-line growth, recurring revenue, new business models, or happier customers, it’s all about the projects. None of this is possible without projects. And the keystone of successful projects? You guessed it. Project Managers.

Image credit – Bernard Spragg .NZ

The Five Hardships of Success

Everything has a half-life, but we don’t behave that way. Especially when it comes to success. The thinking goes – if it was successful last time, it will be successful next time. So, do it again. And again. It’s an efficient strategy – the heavy resources to bring it to life have already been spent. And it’s predictable – the same customers, the same value proposition, the same supply base, the same distribution channel, and the same technology. And it’s dangerous.

Everything has a half-life, but we don’t behave that way. Especially when it comes to success. The thinking goes – if it was successful last time, it will be successful next time. So, do it again. And again. It’s an efficient strategy – the heavy resources to bring it to life have already been spent. And it’s predictable – the same customers, the same value proposition, the same supply base, the same distribution channel, and the same technology. And it’s dangerous.

Success is successful right up until it isn’t. It will go away. But it will take time. A successful product line won’t fall off the face of the earth overnight. It will deliver profits year-over-year and your company will come to expect them. And your company will get hooked on the lifestyle enabled by those profits. And because of the addiction, when they start to drop off the company will do whatever it takes to convince itself all is well. No need to change. If anything, it’s time to double-down on the successful formula.

Here’s a rule: When your successful recipe no longer brings success, it’s not time to double-down.

Success’s decline will be slow, so you have time. But creating a new recipe takes a long time, so it’s time to declare that the decline has already started. And it’s time to learn how to start work on the new recipe.

Hardship 1 – Allocate resources differently. The whole company wants to spend resources on the same old recipes, even when told not to. It’s time to create a funding stream that’s independent of the normal yearly planning cycle. Simply put, the people at the top have to reallocate a part of the operating budget to projects that will create the next successful platform.

Hardship 2 – Work differently. The company is used to polishing the old products and they don’t know how to create new ones. You need to hire someone who can partner with outside companies (likely startups), build internal teams with a healthy disrespect for previous success, create mechanisms to support those teams and teach them how to work in domains of high uncertainty.

Hardship 3 – See value differently. How do you provide value today? How will you provide value when you can’t do it that way? What is your business model? Are you sure that’s your business model? Which elements of your business model are immature? Are you sure? What is the next logical evolution of how you go about your business? Hire someone to help you answer those questions and create projects to bring the solutions to life.

Hardship 4 – Measure differently. When there’s no customer, no technology and no product, there’s no revenue. You’ve got to learn how to measure the value of the work (and the progress) with something other than revenue. Good luck with that.

Hardship 5 – Compensate differently. People that create something from nothing want different compensation than people that do continuous improvement. And you want to move quickly, violate the status quo, push through constraints and create whole new markets. Figure out the compensation schemes that give them what they want and helps them deliver what you want.

This work is hard, but it’s not impossible. But your company doesn’t have all the pieces to make it happen. Don’t be afraid to look outside your company for help and partnership.

Image credit — Insider Monkey

Mike Shipulski

Mike Shipulski