Archive for the ‘Decisions’ Category

How To Allocate Resources

How a company allocates its resources defines its strategy. But it’s tricky business to allocate resources in a way that makes the most of the existing products, services and business models yet accomplishes what’s needed to create the future.

How a company allocates its resources defines its strategy. But it’s tricky business to allocate resources in a way that makes the most of the existing products, services and business models yet accomplishes what’s needed to create the future.

To strike the right balance, and before any decisions on specific projects, allocate the desired spending into three buckets – short, medium and long. Or, if you prefer, Horizon 1, 2 and 3. Use the business objectives to set the weighting. Then, sit next to the CFO for a couple days and allocate last year’s actual spending to the three buckets and compare the actuals with how resources will be allocated going forward. Define the number of people who will work on short, medium and long and how many will move from one bucket to another.

To get the balance right, short term projects are judged relative to short term projects, medium term projects are judged relative to medium term projects and the long term ones are judged against their long term peers. Long term projects cannot be staffed at the expense of short term projects and medium term projects cannot take resources from long term projects. To get the balance right, those are the rules.

To choose the best projects within each bucket, clarity and constraints are more important than ROI. Here are some questions to improve clarity and define the constraints.

How will the customer benefit? It’s best to show the customer using the product or service or experiencing the new business model. Use a hand sketch and few, if any, words. Use one page.

How is it different? In the hand sketch above, draw the novel (different) elements in red.

Who is the new customer? Define where they live, the language they speak and how they get the job done today.

Are there regional constraints? Infrastructure gaps, such as electricity, water, transportation are deal breakers. Language gaps can be big problems, so can regulatory, legal and cultural constraints. If a regional constraint cannot be overcome, do something else.

How will your company make money? Use this formula: (price – cost) x volume. But, be clear about the size of the market today and the size it could be in five years.

How will you make, sell and service it? Include in the cost of the project the cost to overcome organizational capacity/capability constraints. If cost (or time) to close the gaps is prohibitive, do something else.

How will the business model change? If it won’t, strongly consider a different project.

If the investigations show the project is worthwhile, how would you staff the project and when? This is an important one. If the project would be a winner, but there is no one to work on it, do something else. Or, consider stopping a bad project to start the good one.

There’s usually a general tendency to move medium term resources to short term projects and skimp on long term projects. Be respectful of the newly-minted resource balance defined at the start and don’t choose a project from one bucket over a project from another. And don’t get carried away with ROI measured to three significant figures, rather, hold onto the fact that an insurmountable constraint reduces ROI to zero.

And staff projects fully. Partially-staffed projects set expectations that good things are happening, but they never come to be.

Image credit – john curley

Stop bad project and start good ones.

At the most basic level, business is about allocating resources to the best projects and executing those projects well. Said another way, business is about deciding what to work on and then working effectively. But how to go about deciding what to work on? Here is a cascade of questions to start you on your journey.

At the most basic level, business is about allocating resources to the best projects and executing those projects well. Said another way, business is about deciding what to work on and then working effectively. But how to go about deciding what to work on? Here is a cascade of questions to start you on your journey.

What are your company’s guiding principles? Why does it exist? How does it want to go about its life? These questions create context from which to answer the questions that follow. Once defined, all your actions should align with your context.

How has the business environment changed? This is a big one. Everything is impermanent. Change is the status quo. What worked last time won’t work this time. Your success is your enemy because it stunts intentions to work on new things. Define new lines of customer goodness your competitors have developed; define how their technologies have increased performance; search YouTube to see the nascent technologies that will displace you; put yourself two years in the future where your customers will pay half what they pay today. These answers, too, define the context for the questions that follow.

What are you working on? Define your fully-staffed projects. Distill each to a single page. Do they provide new customer value? Are the projects aligned with your company’s guiding principles? For those that don’t, stop them. How do your fully-staffed projects compare to the trajectory of your competitors’ offerings? For those that compare poorly, stop them.

For projects that remain, do they meet your business objectives? If yes, put your head down and execute. If no, do you have better projects? If yes, move the freed up resources (from the stopped projects) onto the new projects. Do it now. If you don’t have better projects, find some. Use lines of evolution for technological systems to figure out what’s next, define new projects and move the resources. Do it now.

The best leading indicator of innovation is your portfolio of fully-staffed projects. Where other companies argue and complain about organizational structure, move your best resources to your best projects and execute. Where other companies use politics to trump logic, move your best resources to your best projects and execute. Where other successful companies hold on to tired business models and do-what-we-did-last-time projects, move your best resources to your best projects and execute.

Be ruthless with your projects. Stop the bad ones and start some good ones. Be clear about what your projects will deliver – define the novel customer value and the technical work to get there. Use one page for each. If you can’t define the novel customer value with a simple cartoon, it’s because there is none. And if you can’t define how you’ll get there with a hand sketch, it’s because you don’t know how.

Define your company’s purpose and use that to decide what to work on. If a project is misaligned, kill it. If a project is boring, don’t bother. If it’s been done before, don’t do it. And if you know how it will go, do something else.

If you’re not changing, you’re dying.

Image credit – David Flam

Is the new one better than the old one?

Successful commercialization of products and services is fueled by one fundamental – making the new one better than the old one. If the new one is better the customer experience is better, the marketing is better, the sales are better and the profits are better.

Successful commercialization of products and services is fueled by one fundamental – making the new one better than the old one. If the new one is better the customer experience is better, the marketing is better, the sales are better and the profits are better.

It’s not enough to know in your heart that the new one is better, there’s got to be objective evidence that demonstrates the improvement. The only way to do that is with testing. There are a number of types testing mechanisms, but whether it’s surveys, interviews or in-the-lab experiments, test results must be quantifiable and repeatable.

The best way I know to determine if the new one is better than the old one is to test both populations with the same test protocol done on the same test setup and measure the results (in a quantified way) using the same measurement system. Sounds easy, but it’s not. The biggest mistake is the confusion between the “same” test conditions and “almost the same” test conditions. If the test protocol is slightly different there’s no way to tell if the difference between new and old is due to goodness of the new design or the badness of the test setup. This type of uncertainty won’t cut it.

You can never be 100% sure that new one is better than the old one, but that’s were statistics come in handy. Without getting deep into the statistics, here’s how it goes. For both population’s test results the mean and standard deviation (spread) are calculated, and taking into consideration the sample size of the test results, the statistical test will tell you if they’re different and confidence of it’s discernment.

The statistical calculations (Student’s t-test) aren’t all that important, what’s important is to understand the implications of the calculations. When there’s a small difference between new and old, the sample size must be large for the statistics to recognize a difference. When the difference between populations is huge, a sample size of one will do nicely. When the spread of the data within a population is large, the statistics need a large sample size or it can’t tell new from old. But when the data is tight, they can see more clearly and need fewer samples to see a difference.

If marketing claims are based on large sample sizes, the difference between new and old is small. (No one uses large sample sizes unless they have to because they’re expensive.) But if in a design review for the new product the sample size is three and the statistical confidence is 95%, new is far better than old. If the average of new is much larger than the average of old and the sample size is large yet the confidence is low, the statistics know the there’s a lot of variability within the populations. (A visual check should show the distributions to more wide than tall.)

The measurement systems used in the experiments can give a good indication of the difference between new and old. If the measurement system is expensive and complicated, likely the difference between new and old is small. Like with large sample sizes, the only time to use an expensive measurement system is when it is needed. And when the difference between new and old is small, the expensive measurement system’s ability accurately and repeatably measure small differences (micrometers vs. meters).

If you need large sample sizes, expensive measurement systems and complicated statistical analyses, the new one isn’t all that different from the old one. And when that’s the case, your new profits will be much like your old ones. But if your naked eye can see the difference with a back-to-back comparison using a sample size of one, you’re on to something.

Image credit – amanda tipton

Selling New Products to New Customers in New Markets

There’s a special type of confusion that has blocked many good ideas from seeing the light of day. The confusion happens early in the life of a new technology when it is up and running in the lab but not yet incorporated in a product. Since the new technology provides a new flavor of customer goodness, it has the chance to create incremental sales for the company. But, since there are no products in the market that provide the novel goodness, by definition there can be no sales from these products because they don’t yet exist. And here’s the confusion. Organizations equate “no sales” with “no market”.

There’s a special type of confusion that has blocked many good ideas from seeing the light of day. The confusion happens early in the life of a new technology when it is up and running in the lab but not yet incorporated in a product. Since the new technology provides a new flavor of customer goodness, it has the chance to create incremental sales for the company. But, since there are no products in the market that provide the novel goodness, by definition there can be no sales from these products because they don’t yet exist. And here’s the confusion. Organizations equate “no sales” with “no market”.

There’s a lot of risk with launching new products with new value propositions to new customers. You invest resources to create the new technologies and products, create the sales tools, train the sales teams, and roll it out well. And with all this hard work and investment, there’s a chance no one will buy it. Launching a product that improves on an existing product with an existing market is far less risky – customers know what to expect and the company knows they’ll buy it. The status quo when stable if all the players launch similar products, right up until it isn’t. When an upstart enters the market with a product that offers new customer goodness (value proposition) the same-old-same-old market-customer dynamic is changed forever.

A market-busting product is usually launched by an outsider – either a big player moves into a new space or a startup launches its first product. Both the new-to-market big boy and the startup have a far different risk profile than the market leader, not because their costs to develop and launch a new product are different, but because they have not market share. For them, they have no market share to protect any new sales are incremental. But for the established players, most of their resources are allocated to protecting their existing business and any resources diverted toward a new-to-market product is viewed as a loss of protective power and a risk to their market share and profitability. And on top of that, the incumbent sees sales of the new product as a threat to sales of the existing products. There’s a good chance that their some of their existing customers will prefer the new goodness and buy the new-to-market product instead of the tried-and-true product. In that way, sales growth of their own new product is seen as an attack no their own market share.

Business leaders are smart. Theoretically, they know when a new product is proposed, because it hasn’t launched yet, there can be no sales. Yet, practically, because their prime directive to protect market share is so all-encompassing and important, their vision is colored by it and they confound “no sales” with “no market”. To move forward, it’s helpful to talk about their growth objectives and time horizon.

With a short time horizon, the best use of resources is to build on what works – to launch a product that builds on the last one. But when the discussion is moved further out in time, with a longer time horizon it’s a high risk decision to hold on tightly to what you have as the market changes around you. Eventually, all recipes run out of gas like Henry Ford’s Model T. And the best leading indicator of running low on fuel is when the same old recipe cannot deliver on medium-term growth objectives. Short term growth is still there, but further out they are not. Market forces are squeezing the juice out of your past success.

Ultimately, out of desperation, the used-to-be market leader will launch a new-to-market product. But it’s not a good idea to do this work only when it’s the only option left. Before they’re launched, new products that offer new value to customers will, by definition, have no sales. Try to hold back the fear-based declaration that there is no market. Instead, do the forward-looking marketing work to see if there is a market. Assume there is a market and build some low cost learning prototypes and put them in front of customers. These prototypes don’t yet have to be functional; they just have to communicate the idea behind the new value proposition.

Before there is a market, there is an idea that a market could exist. And before that could-be market is served, there must be prototype-based verification that the market does in fact exist. Define the new value proposition, build inexpensive prototypes and put them in front of customers. Listen to their feedback, modify the prototypes and repeat.

Instead of arguing whether the market exists, spend all your energy proving that it does.

Image credit — lensletter

Step-Wise Learning

At every meeting you have a chance to move things forward or hold them back. When a new idea is first introduced it’s bare-naked. In its prenatal state, it’s wobbly and can’t stand on its own and is vulnerable to attack. But since it’s not yet developed, it’s impressionable and willing to evolve into what it could be. With the right help it can go either way – die a swift death or sprout into something magical.

At every meeting you have a chance to move things forward or hold them back. When a new idea is first introduced it’s bare-naked. In its prenatal state, it’s wobbly and can’t stand on its own and is vulnerable to attack. But since it’s not yet developed, it’s impressionable and willing to evolve into what it could be. With the right help it can go either way – die a swift death or sprout into something magical.

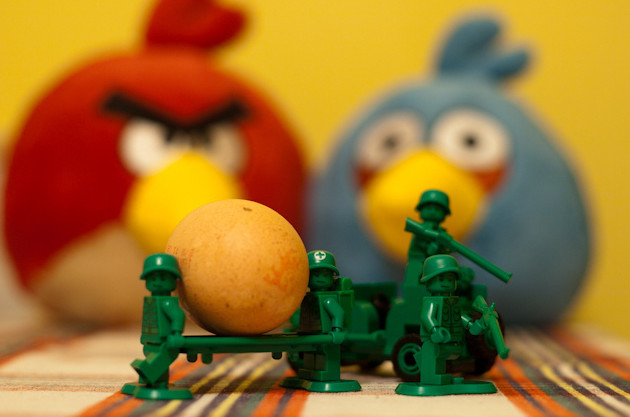

Early in gestation, the most worthy ideas don’t look that way. They’re ugly, ill-formed, angry or threatening. Or, they’re playful, silly or absurd. Depending on your outlook, they can be a member of either camp. And as your outlook changes, they can jump from one camp to the other. Or, they can sit with one leg in each. But none of that is about the idea, it’s all about you. The idea isn’t a thing in itself, it’s a reflection of you. The idea is nothing until you attach your feelings to it. Whether it lives or dies depends on you.

Are you looking for reasons to say yes or reasons to say no?

On the surface, everyone in the organization looks like they’re fully booked with more smart goals than they can digest and have more deliverables than they swallow, but that’s not the case. Though it looks like there’s no room for new ideas, there’s plenty of capacity to chew on new ideas if the team decides they want to. Every team can spare and hour or two a week for the right ideas. The only real question is do they want to?

If someone shows interest and initiative, it’s important to support their idea. The smallest acceptable investment is a follow-on question that positively reinforces the behavior. “That’s interesting, tell me more.” sends the right message. Next, “How do you think we should test the idea?” makes it clear you are willing to take the next step. If they can’t think of a way to test it, help them come up with a small, resource-lite experiment. And if they respond with a five year plan and multi-million dollar investment, suggest a small experiment to demonstrate worthiness of the idea. Sometimes it’s a thought experiment, sometimes it’s a discussion with a customer and sometimes it’s a prototype, but it’s always small. Regardless of the idea, there’s always room for a small experiment.

Like a staircase, a series of small experiments build on each other to create big learning. Each step is manageable – each investment is tolerable and each misstep is survivable – and with each experiment the learning objective is the same: Is the new idea worthy of taking the next step? It’s a step-wise set of decisions to allocate resources on the right work to increase learning. And after starting in the basement, with step-by-step experimentation and flight-by-flight investment, you find yourself on the fifth floor.

This is about changing behavior and learning. Behavior doesn’t change overnight, it changes day-by-day, step-by-step. And it’s the same for learning – it builds on what was learned yesterday. And as long at the experiment is small, there can be no missteps. And it doesn’t matter what the first experiment is all about, as long as you take the first step.

Your team will recognize your new behavior because it respectful of their ideas. And when you respect their ideas, you respect them. Soon enough you will have a team that stands taller and runs small experiments on their own. Their experiments will grow bolder and their learning will curve will steepen. Then, you’ll struggle to keep up with them, and you’ll have them right where you want them.

image credit — Rob Warde

Is it novel?

Agree or not, companies think they have to grow to survive. (I don’t believe it.) For companies of all sizes and shapes, growth is the single most important forcing function. Is has tidal wave power, and whether you’re a surfer, sailor or power-boater, it’s important to respect it. More than that, when push comes to shove, it’s the only wave in town.

Agree or not, companies think they have to grow to survive. (I don’t believe it.) For companies of all sizes and shapes, growth is the single most important forcing function. Is has tidal wave power, and whether you’re a surfer, sailor or power-boater, it’s important to respect it. More than that, when push comes to shove, it’s the only wave in town.

Companies’ recipe for growth is simple: make more, sell more. And some keep it simpler: sell more.

The best growth: sell new products or provide new services to new customers; next best: sell new to the same customers; next next best: sell more of the same to the same customers. The last flavor is the easiest, right up until it isn’t. And once it isn’t, companies must come up with new things to sell. That works for a while, until it doesn’t. Then, and only then, after exhausting all other possibilities, companies must create real newness and try to sell it to strangers.

The model works well as long as everyone in the industry follows it. But when an up-start outsider enters the market back-to-front, the wheels fall off. When they develop useful newness before you and sell it to your customers (new customers for them), that’s not good. And that’s why it’s so important to start with different — right now.

To help your company do more work that’s different, start with an inventory of your novelty. Novel work is work that creates difference, and that difference can be defined only in comparison with the state-of-the-art (what is, or the baseline system). Start with a functional analysis of your state-of-the-art. Create a block diagram of your business model, your most successful product and the service that defines your brand. Take a look at your technology and new product development projects and flag the ones that will create things that aren’t on your three functional analyses. (Improvement projects, because they improve what is, cannot be flagged as novel.)

Put all your novelty on one page and decide if you like it. (No way around it, how you respond to the level and type of novelty in your quiver is a judgment call.) If you like what you see, keep going. If you don’t, stop some improvement projects and start some projects that create useful novelty. The stopping will not come easy. Existing projects have momentum and people have personal attachment to them. The only thing powerful enough to stop them is the all-powerful growth objective. If company leaders learn the existing projects won’t meet the growth objective, the tidal wave will sweep away some lesser projects to make room for new ones.

There will be great internal pressure to add projects without stopping some, but that won’t work. Everyone is fully booked and can’t deliver on additional projects even if you tell them to. If you’re not willing to stop projects, you’re better off staying the course and waiting until you finish one before you start a project to increase your novelty score.

Novelty is good because there’s more upside potential, and improvement is good because there’s more certainty. One is not better than the other. You need both.

In the end, you’re going to have to judge if you’re happy with what you’ve got. That’s a difficult task that no one can make easier for you. But it is possible to use your judgment better. If you can clearly call out what’s novel and what’s not, you’re on your way.

Image credit – s3aphotography (image cropped)

The People Business

Things don’t happen on their own, people make them happen.

With all the new communication technologies and collaboration platforms it’s easy to forget that what really matters is people. If people don’t trust each other, even the best collaboration platforms will fall flat, and if they don’t respect each other, they won’t communicate – even with the best technology.

Companies put stock in best practices like they’re the most important things, but they’re not. Because of this unnatural love affair, we’re blinded to the fact people are what make best practices best. People create them, people run them, and people improve them. Without people there can be no best practices, but on the flip-side, people can get along just fine without best practices. (That says something, doesn’t it?) Best practices are fine when processes are transactional, but few processes are 100% transactional to the core, and the most important processes are judgement-based. In a foot race between best practices and good judgement, I’ll take people and their judgment – every day.

Without a forcing function, there can be no progress, and people are the forcing function. To be clear, people aren’t the object of the forcing function, they are the forcing function. When people decide to commit to a cause, the cause becomes a reality. The new reality is a result – a result of people choosing for themselves to invest their emotional energy. People cannot be forced to apply their life force, they must choose for themselves. Even with today’s “accountable to outcomes” culture, the power of personal choice is still carries the day, though sometimes it’s forced underground. When pushed too hard, under the cover of best practice, people choose to work the rule until the clouds of accountability blow over.

When there’s something new to do, processes don’t do it – people do. When it’s time for some magical innovation, best practices don’t save the day – people do. Set the conditions for people to step up and they will; set the conditions for them to make a difference and they will. Use best practices if you must, but hold onto the fact that whatever business you’re in, you’re in the people business.

Image credit – Vicki & Chuck Rogers

To make the right decision, use the right data.

When it’s time for a tough decision, it’s time to use data. The idea is the data removes biases and opinions so the decision is grounded in the fundamentals. But using the right data the right way takes a lot of disciple and care.

When it’s time for a tough decision, it’s time to use data. The idea is the data removes biases and opinions so the decision is grounded in the fundamentals. But using the right data the right way takes a lot of disciple and care.

The most straightforward decision is a decision between two things – an either or – and here’s how it goes.

The first step is to agree on the test protocols and measure systems used to create the data. To eliminate biases, this is done before any testing. The test protocols are the actual procedural steps to run the tests and are revision controlled documents. The measurement systems are also fully defined. This includes the make and model of the machine/hardware, full definition of the fixtures and supporting equipment, and a measurement protocol (the steps to do the measurements).

The next step is to create the charts and graphs used to present the data. (Again, this is done before any testing.) The simplest and best is the bar chart – with one bar for A and one bar for B. But for all formats, the axes are labeled (including units), the test protocol is referenced (with its document number and revision letter), and the title is created. The title defines the type of test, important shared elements of the tested configurations and important input conditions. The title helps make sure the tested configurations are the same in the ways they should be. And to be doubly sure they’re the same, once the graph is populated with the actual test data, a small image of the tested configurations can be added next to each bar.

The configurations under test change over time, and it’s important to maintain linkage between the test data and the tested configuration. This can be accomplished with descriptive titles and formal revision numbers of the test configurations. When you choose design concept A over concept B but unknowingly use data from the wrong revisions it’s still a data-driven decision, it’s just wrong one.

But the most important problem to guard against is a mismatch between the tested configuration and the configuration used to create the cost estimate. To increase profit, test results want to increase and costs wants to decrease, and this natural pressure can create divergence between the tested and costed configurations. Test results predict how the configuration under test will perform in the field. The cost estimate predicts how much the costed configuration will cost. Though there’s strong desire to have the performance of one configuration and the cost of another, things don’t work that way. When you launch you’ll get the performance of AND cost of the configuration you launched. You might as well choose the configuration to launch using performance data and cost as a matched pair.

All this detail may feel like overkill, but it’s not because the consequences of getting it wrong can decimate profitability. Here’s why:

Profit = (price – cost) x volume.

Test results predict goodness, and goodness defines what the customer will pay (price) and how many they’ll buy (volume). And cost is cost. And when it comes to profit, if you make the right decision with the wrong data, the wheels fall off.

Image credit – alabaster crow photographic

Prototypes Are The Best Way To Innovate

If you’re serious about innovation, you must learn, as second nature, to convert your ideas into prototypes.

If you’re serious about innovation, you must learn, as second nature, to convert your ideas into prototypes.

Funny thing about ideas is they’re never fully formed – they morph and twist as you talk about them, and as long as you keep talking they keep changing. Evolution of your ideas is good, but in the conversation domain they never get defined well enough (down to the nuts-and-bolts level) for others (and you) to know what you’re really talking about. Converting your ideas into prototypes puts an end to all the nonsense.

Job 1 of the prototype is to help you flesh out your idea – to help you understand what it’s all about. Using whatever you have on hand, create a physical embodiment of your idea. The idea is to build until you can’t, to build until you identify a question you can’t answer. Then, with learning objective in hand, go figure out what you need to know, and then resume building. If you get to a place where your prototype fully captures the essence of your idea, it’s time to move to Job 2. To be clear, the prototype’s job is to communicate the idea – it’s symbolic of your idea – and it’s definitely not a fully functional prototype.

Job 2 of the prototype is to help others understand your idea. There’s a simple constraint in this phase – you cannot use words – you cannot speak – to describe your prototype. It must speak for itself. You can respond to questions, but that’s it. So with your rough and tumble prototype in hand, set up a meeting and simply plop the prototype in front of your critics (coworkers) and watch and listen. With your hand over your mouth, watch for how they interact with the prototype and listen to their questions. They won’t interact with it the way you expect, so learn from that. And, write down their questions and answer them if you can. Their questions help you see your idea from different perspectives, to see it more completely. And for the questions you cannot answer, they the next set of learning objectives. Go away, learn and modify your prototype accordingly (or build a different one altogether). Repeat the learning loop until the group has a common understanding of the idea and a list of questions that only a customer can answer.

Job 3 is to help customers understand your idea. At this stage it’s best if the prototype is at least partially functional, but it’s okay if it “represents” the idea in clear way. The requirement is prototype is complete enough for the customer can form an opinion. Job 3 is a lot like Job 2, except replace coworker with customer. Same constraint – no verbal explanation of the prototype, but you can certainly answer their direction questions (usually best answered with a clarifying question of your own such as “Why do you ask?”) Capture how they interact with the prototype and their questions (video is the best here). Take the data back to headquarters, and decide if you want to build 100 more prototypes to get a broader set of opinions; build 1000 more and do a small regional launch; or scrap it.

Building a prototype is the fastest, most effective way to communicate an idea. And it’s the best way to learn. The act of building forces you to make dozens of small decisions to questions you didn’t know you had to answer and the physical nature the prototype gives a three dimensional expression of the idea. There may be disagreement on the value of the idea the prototype stands for, but there will be no ambiguity about the idea.

If you’re not building prototypes early and often, you’re not doing innovation. It’s that simple.

How do you choose what to work on?

There are always too many things to do, too much to work on. And because of this, we must choose. Some have more choice than others, but we all have choice. And to choose, there are several lenses we look through.

There are always too many things to do, too much to work on. And because of this, we must choose. Some have more choice than others, but we all have choice. And to choose, there are several lenses we look through.

What’s good enough? If it’s good enough, there’s no need to work on it. “Good enough” means it’s not a constraint; it’s not in the way of where you want to go.

What’s not good enough? If it’s not good enough, it’s important to work on it. “Not good enough” means it IS a constraint; it IS in the way; it’s blocking your destination.

What’s not happening? If it’s not happening and the vacancy is blocking you from your destination, work on it. Implicit in the three lenses is the assumption of an idealized future state, a well-defined endpoint.

It’s the known endpoint that’s used to judge if there’s a blocking constraint or something missing. And there are two schools of thought on idealized future states – the systems, environment, competition, and interactions are well understood and idealized future states are the way to go, or things are too complex to predict how things will go. If you’re a member of the idealized-future-state-is-the-way-to-go camp, you’re home free – just use your best judgment to choose the most important constraints and hit them hard. If you’re a believer in complexity and its power to scuttle your predictions, things are a bit more nuanced.

Where the future state folks look through the eyepiece of the telescope toward the chosen nebula, the complexity folks look through the other end of the telescope toward the atomic structure of where things are right now. Complexity thinkers think it’s best to understand where you are, how you got there, and the mindset that guided your journey. With that knowledge you can rough out the evolutionary potential of the future and use that to decide what to work on.

If you got here by holding on to what you had, it’s pretty clear you should try to do more of that, unless, of course, the rules have changed. And to figure out if the rules have changed? Well, you should run small experiments to test if the same rules apply in the same way. Then, do more of what worked and less of what didn’t. And if nothing works even on a small scale, you don’t have anything to hold onto and it’s time to try something altogether new.

If you got here with the hybrid approach – by holding on to what you had complimented with a healthy dose of doing new stuff (innovation), it’s clear you should try to do more of that, unless, of course, you’re trying to expand into new markets which have different needs, different customers, and different pocketbooks. To figure out what will work, runs small experiments, and do more of what worked and less of what didn’t. If nothing works, your next round of small experiments should be radically different. And again, more of what worked, less of what didn’t.

And if you’re a young company and have yet to arrive, you’re already running small experiments to see what will work, so keep going.

There’s a half-life to the things that got us here, and it’s difficult to predict their decay. That’s why it’s best to take small bets on a number of new fronts – small investment, broad investigation of markets, and fast learning. And there’s value in setting a rough course heading into the future, as long as we realize this type of celestial navigation must be informed by regular sextant sightings and course corrections they inform.

Image credit – Hubble Heritage.

The Complexity Conundrum

In school the problems you were given weren’t really problems at all. In school you opened the book to a specific page and there, right before you in paragraph form and numbered consecutively, was a neat row of “problems”. They were fully-defined, with known inputs, a formal equation that defined the system’s response, and one right answer. Nothing extra, nothing missing, nothing contradictory. Today’s problems are nothing like that.

In school the problems you were given weren’t really problems at all. In school you opened the book to a specific page and there, right before you in paragraph form and numbered consecutively, was a neat row of “problems”. They were fully-defined, with known inputs, a formal equation that defined the system’s response, and one right answer. Nothing extra, nothing missing, nothing contradictory. Today’s problems are nothing like that.

Today’s problems don’t have a closed form solution; today’s problems don’t have a right answer. Three important factors come into play: companies and their systems are complex; the work, at some level, is always new; and people are always part of the equation.

It’s not that companies have a lot of moving parts (that makes them complicated); it’s that the parts can respond differently in different situations, can change over time (learn), and the parts can interact and change each others’ response (that’s complex). When you’re doing work you did last time, there’s a pretty good chance the system will perform like it did last time. But it’s a different story when the inputs are different, when the work is new.

When the work is new, there’s no precedent. The inputs are new and the response is newer. Perturb the system in a new way and you’re not sure how it will respond. New interactions between preciously unreactive parts make for exciting times. The seemingly unconnected parts ping each other through the ether, stiffen or slacken, and do their thing in a whole new way. Repeatability is out the window, and causal predictability is out of the question. New inputs (new work) slathers on layers of unknownness that must be handled differently.

Now for the real complexity culprit – people. Companies are nothing more than people systems in the shape of a company. And the work, well, that’s done by people. And people are well known to be complex. In a bad mood, we respond one way; confident and secure we respond in another. And people have memory. If something bad happened last time, next time we respond differently. And interactions among people are super complex – group think, seniority, trust, and social media.

Our problems swim with us in a hierarchical sea of complexity. That’s just how it is. Keep that in mind next time you put together your Gantt chart and next time you’re asked to guarantee the outcome of an innovation project.

Complexity is real, and there are real ways to handle it. But that’s for another time. Until then, I suggest you bone up on Dave Snowden’s work. When it comes to complexity, he’s the real deal.

Image credit – miguelb.

Mike Shipulski

Mike Shipulski